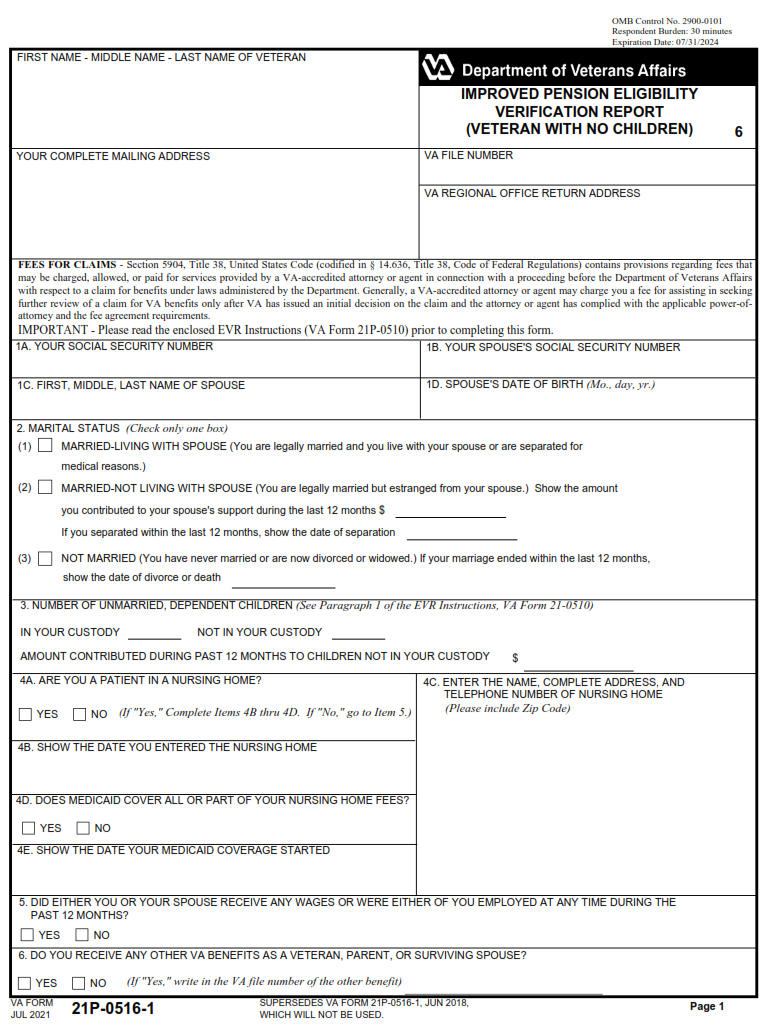

VAFORMS.NET – VA Form 21P-0516-1 – Improved Pension Eligibility Verification Report (Veteran with No Children) – Whether you’re a veteran looking for an improved pension, or you are a person who works for an employer that offers a pension, you might want to fill out VA Form 21P-0516-1. It’s a form that helps determine whether or not you can qualify for an improved pension.

Download VA Form 21P-0516-1 – Improved Pension Eligibility Verification Report (Veteran with No Children)

| Form Number | VA Form 21P-0516-1 – |

| Form Title | Improved Pension Eligibility Verification Report (Veteran with No Children) |

| Edition Date | May 2022 |

| File Size | 844 KB |

VA Form 21P-0516-1 (1901 downloads )

Where Can I Find a VA Form 21P-0516-1?

Whether you’re a veteran or someone who knows someone who is, it’s always good to know where to find the most useful and interesting forms and documents. The Department of Veterans Affairs offers a variety of documents and forms to choose from. The VA Form 21P-0516-1 is one of them.

Basically, the VA Form 21P-0516-1 is an online template designed to simplify high-volume document management. The template includes an eSigning option, advanced tools, and detailed instructions. Users can fill out the form with ease, edit it, and print it out with ease.

The Department of Veterans Affairs rolled out the VA Form 21P-0516-1 on June 1, 2018. The form is used countrywide, and you can download a fillable version as a PDF. It’s also one of the most widely used forms in the agency’s arsenal. The form can be used to verify the existence of a beneficiary, verify the recipient’s payment, and provide other important information. The form is a good example of how the government is using technology to keep track of its beneficiaries and ensure their ongoing eligibility.

The VA Form 21P-0516-1 may be more streamlined, but it does come with a few pitfalls. For instance, you might be required to sign a power of attorney affidavit if you are applying for the form on someone else’s behalf.

VA Form 21P-0516-1 – Improved Pension Eligibility Verification Report (Veteran with No Children)

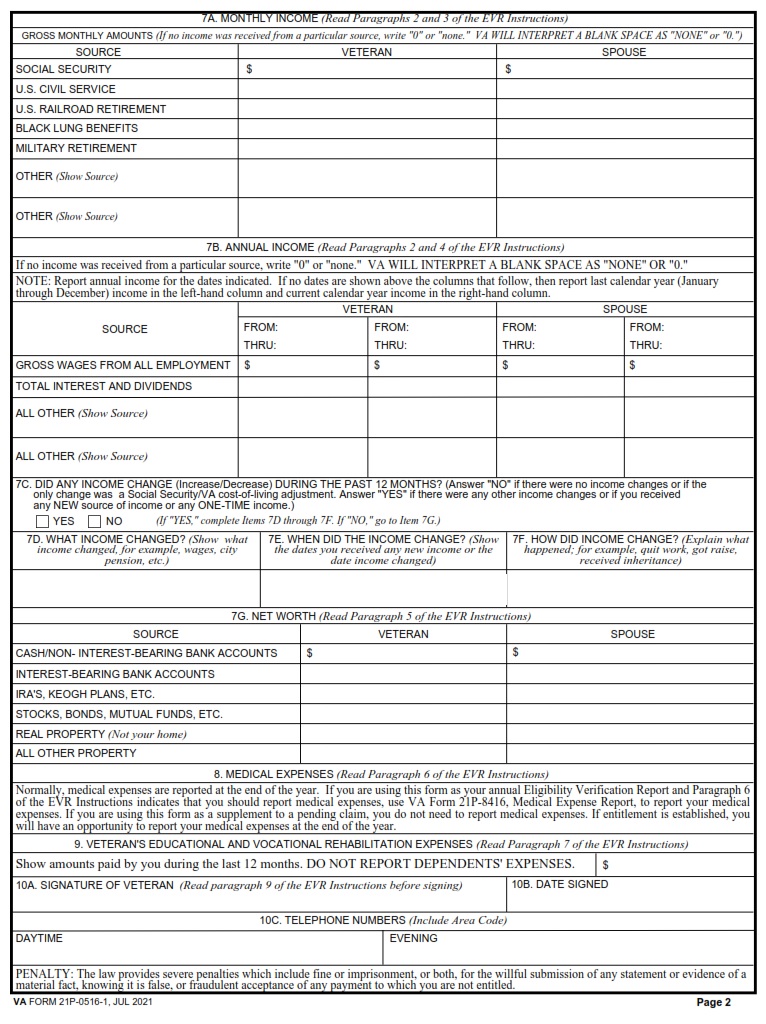

Whether you’re a claimant or a beneficiary, you will have to file an Eligibility Verification Report (EVR) each year. These forms are used to determine the eligibility of claimants for VA benefits. VA will also use these reports to determine the amount of the monthly pension that a claimant should receive.

The VA will use the claimant’s income to determine whether he or she has enough Net Worth to qualify for the benefits. Countable income includes income from Social Security, Welfare payments, and maintenance provided by friends and relatives. Other non-countable income is set off against the total countable income, reducing the amount of income that a claimant must have.

The VA does not have a “bright line” upper limit on the number of assets that a claimant can have. In some cases, claimants can have less than $80,000 in countable assets. This is arbitrary, but it does not disqualify claimants who give away assets.

VA has created three programs to allow claimants to retain tangible personal property and retain their residence. Those programs are the Improved Pension, Housebound Pension, and the Aid and Attendance Pension. Claimants may qualify for the Improved Pension even if they are married. Those claimants must notify the VA of any changes in their entitlement factors.