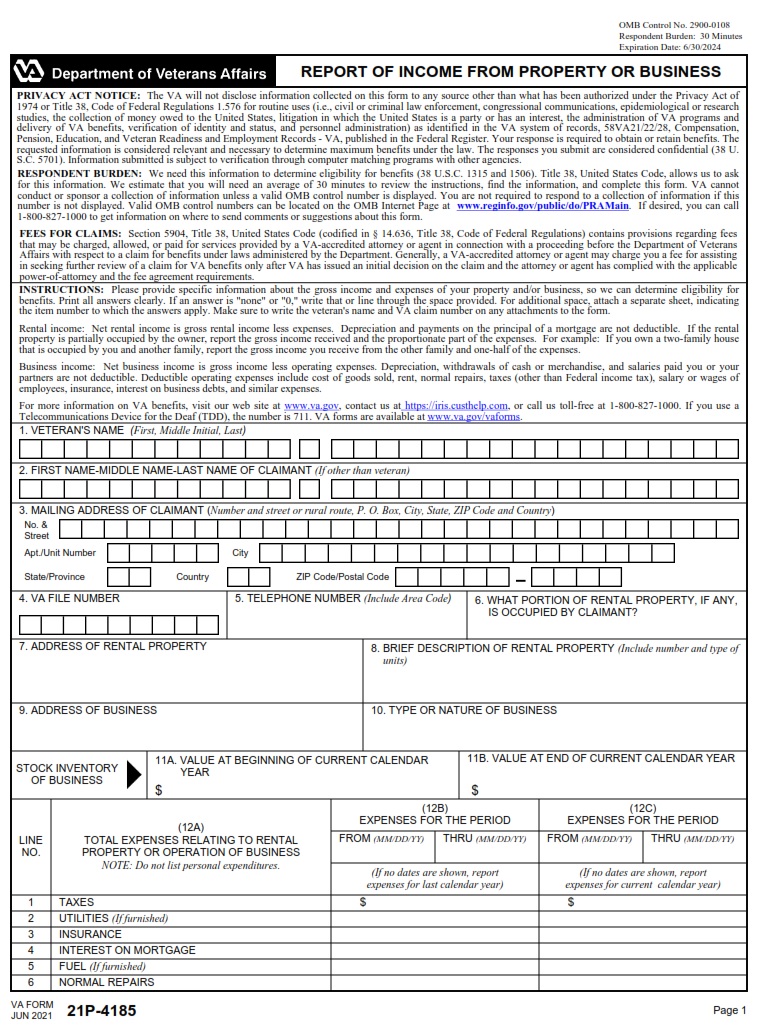

VAFORMS.NET – VA Form 21P-4185 – Report of Income from Property or Business – Using the VA Form 21P-4185 is one of the easiest ways to report income from a property. But it is important to know exactly what you need to do to fill out the form and where you can find it.

Download VA Form 21P-4185 – Report of Income from Property or Business

| Form Number | VA Form 21P-4185 |

| Form Title | Report of Income from Property or Business |

| Edition Date | March 2022 |

| File Size | 861 KB |

VA Form 21P-4185 (1579 downloads )

Where Can I Find a VA Form 21P-4185?

Depending on your VA benefits entitlement, you might need to fill out VA Form 21P-4185. It is a short form used to report income from a rental property. The form also helps determine the appropriate rate of payment.

The form also includes the VA’s requisite information about VA-accredited attorneys. The aforementioned acronym is also found on the reverse side. If you’re considering a legal matter pertaining to your VA benefits entitlement, you should consult with an attorney in your local VA office before deciding on a course of action.

The form can be found at your local VA office or on the VA website. It is available in both English and Spanish. If you need assistance in filling out the form, call your local VA office or the VA’s toll-free hotline at 1-877-VETS-HELP.

The form is used to determine eligibility for VA benefits and is one of the most popular forms in the VA system. For example, you might be eligible for the VA’s Parents’ Dependency and Indemnity Compensation (PDI) if your parent served in the armed forces and you are a dependent. Depending on your circumstances, you may also be eligible for a VA pension. The VA might also count the cost of in-home care as a medical expense, which you can claim as a benefit.

VA Form 21P-4185 – Report of Income from Property or Business

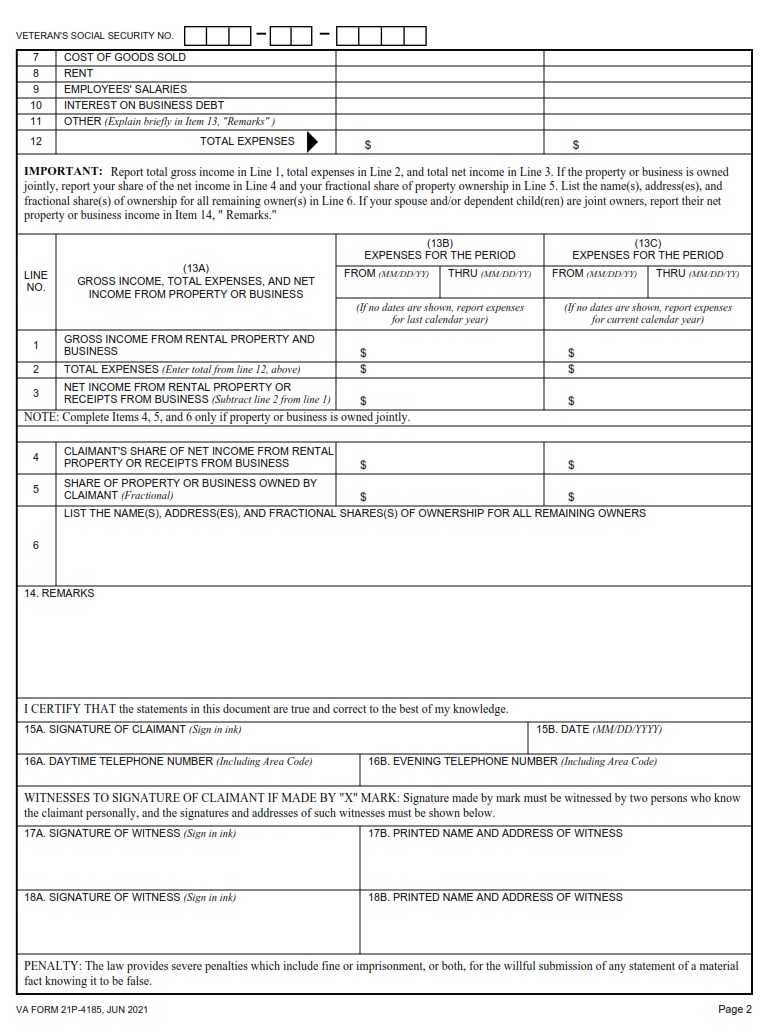

Using VA Form 21P-4185 to report income from the property is a way for the Department of Veterans Affairs to gather the information needed to determine whether a veteran is eligible for VA benefits. The form may also ask for information about the type of property involved. It may also request money spent on a property manager. The form is confidential and is used to determine eligibility for VA benefits.

The form should be completed by the veteran and his or her spouse. It is important that all income sources are reported. The form must be returned to the Veteran Service Office. If a spouse cannot sign the form, an alternate signer should be chosen.

The form should be filled out with the veteran’s Social Security number on each page. The form is confidential and will be used to determine whether the veteran is eligible for VA benefits.

The form should also be filled out by the veteran’s primary care provider. The form should include all medical expenses. Medical expenses include medical insurance, medication, and IHSS payment. The expenses must be recorded as a monthly amount.

The form should also be filled out if the veteran owns a business. The income from the business should be reported in line 4. The form may also ask for information about property owned by the veteran.