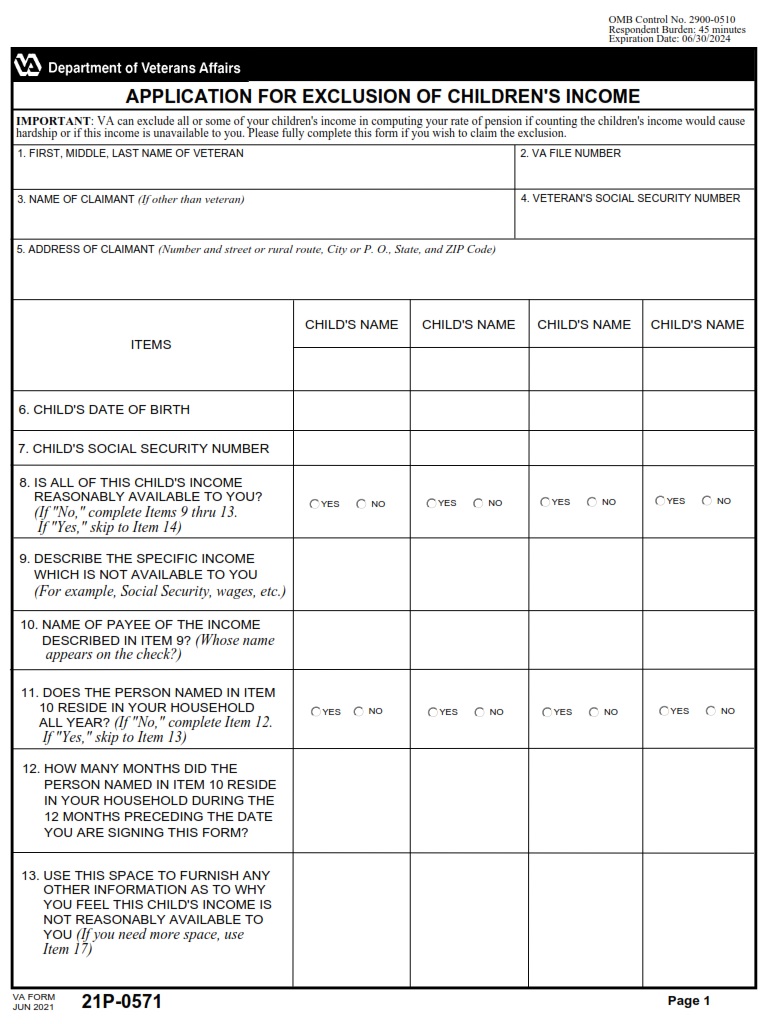

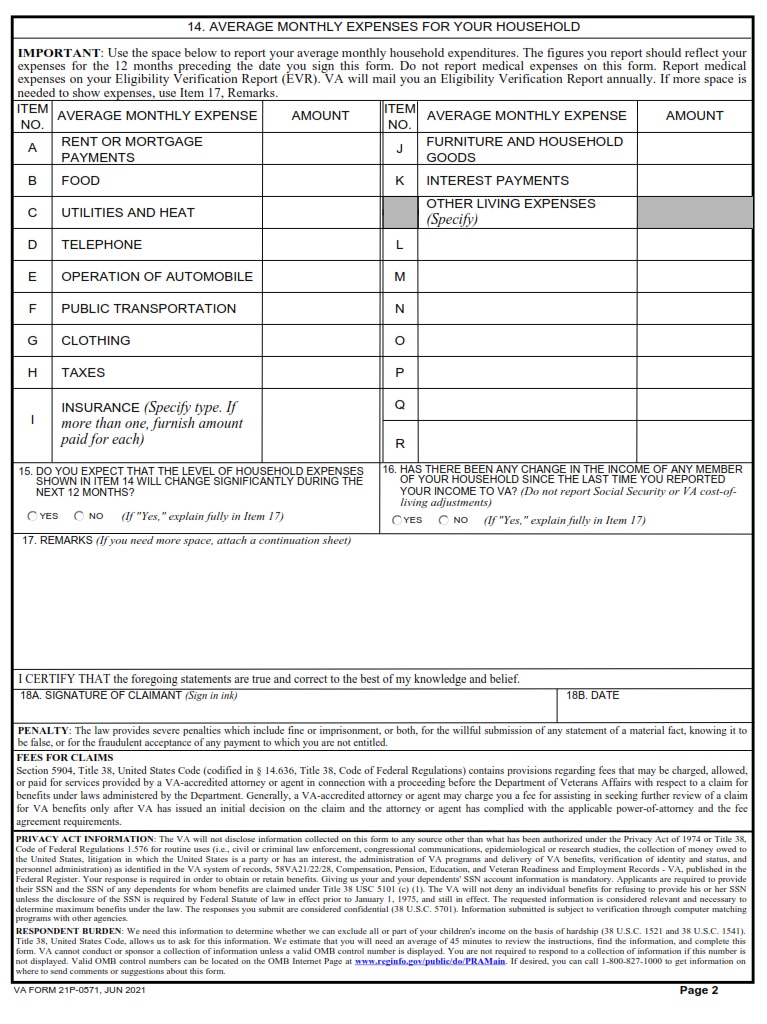

VAFORMS.NET – VA Form 21P-0571 – Application for Exclusion of Children’s Income – Having a VA Form 21P-0571 is a necessity if you have filed for the benefit of the disability compensation program. Having this form can be a big help if you are preparing for an appeal. Having this form can also be a big help if you are trying to make an exclusion for yourself. You will need to fill out the VA Form 21P-0571 and send it to the VA to be processed. The VA will be able to use the form to find out whether or not you have received any benefits under the disability compensation program.

Download VA Form 21P-0571 – Application for Exclusion of Children’s Income

| Form Number | VA Form 21P-0571 |

| Form Title | Application for Exclusion of Children’s Income |

| Edition Date | March 2022 |

| File Size | 2 MB |

VA Form 21P-0571 (2214 downloads )

What is a VA Form 21P-0571?

Using VA Form 21P-0571 to determine if you qualify for a pension is not for the faint of heart. To be sure, the VA is well-staffed with experts that will be more than happy to help. One of the best ways to learn the ropes is to ask questions and if you have the patience of a saint you may be rewarded. There are many pitfalls to avoid. For example, a high-powered executive may not appreciate your efforts. Getting an employee to say no is a challenge. The best way to overcome this is to ask polite questions and not be shy about sharing your financial and personal details.

Where Can I Find a VA Form 21P-0571?

Whether you are a VA veteran or not, you may need to fill out VA Form 21P-0571 to find out how much income your children can earn. If you’re not sure, you can visit the VA website to learn more.

VA Form 21P-0571 is a form used to determine if you are able to include your children’s income in your pension benefit. The form is confidential and the information will be used only for the purposes stated in Section 1. However, the form is being withdrawn from the Compensation Service and transferred to the Pension and Fiduciary Service.

Before you begin completing the form, you should read the Privacy Act. The VA will never use your personal information for illegal purposes. You must have written permission from the VA before it can collect your information. VA officials must include a clear explanation of why information is being collected. They must also include a list of individuals who reviewed the review. If a person does not provide written permission, they will not be able to receive or retain VA benefits.

VA Form 21P-0571 also has a section for excluding children’s income if you are unable to include it. If you choose to exclude your children’s income, you will have to provide a letter requesting a hardship waiver.

VA Form 21P-0571 – Application for Exclusion of Children’s Income

Among the numerous VA forms, you will encounter, Form 21P-0571 – Application for Exclusion of Children’s Income has no shortage of merit. In fact, it is a great way to determine what sort of benefits your loved ones are entitled to. To determine the appropriate level of benefits, the Department of Veterans Affairs requires you to complete a series of questions about your spouse, children, and pets. The result is a list of benefits tailored to your specific needs. In addition, the form contains a few enticing surprises. For example, you might get a free iPad mini for your babes!

The form contains a plethora of useful information, allowing you to make informed decisions and avoid costly mistakes. It is a great way to get a jumpstart on your benefits applications. For example, you can use the form to determine whether you are eligible for a child’s education loan. Alternatively, you might be able to use the form to determine whether you qualify for a supplemental stipend. Lastly, the form can help you make sure you aren’t receiving a duplicate payment. This can save you a bundle on your taxes.

For more information, check out the VA website’s benefits page, or consult a Veteran Service Officer.