VAFORMS.NET – VA Form 26-0592 – Counseling Checklist for Military Homebuyers – The VA Form 26-0592 is a checklist used by the Department of Veterans Affairs (VA) to help military veterans and their families to find and address their health and medical needs. The VA’s form, which can be found online, includes a series of questions relating to the services that are provided by the VA. It also provides a way for veterans to list any problems that they are having.

Download VA Form 26-0592 – Counseling Checklist for Military Homebuyers

| Form Number | VA Form 26-0592 |

| Form Title | Counseling Checklist for Military Homebuyers |

| Edition Date | June 2022 |

| File Size | 310 KB |

VA FORM 26-0592 (2055 downloads )

What is a VA Form 26-0592?

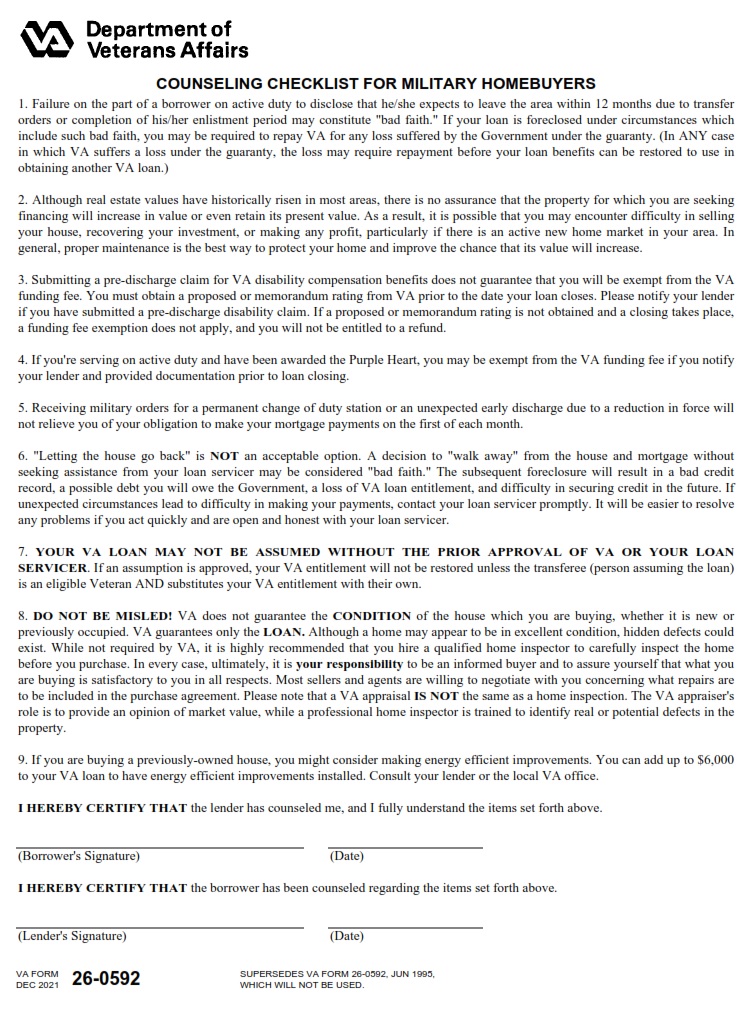

VA Form 26-0592 is a formal document given to active service members who are planning to purchase a home. The purpose of this form is to advise military homebuyers on the basic rules and options available to them. It also contains information about recent changes in VA home loan policy.

Active-duty Service members applying for a VA-guaranteed home loan must be advised to use VA Form 26-0592. They must provide evidence of eligibility for the VA home loan benefit. This includes the applicant’s VA Certificate of Eligibility.

If the applicant is a veteran, he or she may be exempt from paying the VA funding fee. These fees are collected by the VA on all VA loans. However, a VA guaranty is an effective condition of the assumption of the loan. Without full repayment of Government losses, the guarantee cannot be restored.

A down payment of at least 10 percent is an unusually strong positive underwriting factor. Likewise, a significant cash reserve is a positive underwriting factor. Other considerations include the length of time the applicant has been in employment and the number of dependents. Depending on the type of employment, income is also affected.

An Energy Efficient Improvements option is available for borrowers who can demonstrate that the property is in need of energy-efficient improvements. Up to $6,000 can be added to the loan.

Where Can I Find a VA Form 26-0592?

The VA Form 26-0592 is a formal document given to active service members who plan to purchase a home with a VA mortgage loan. It contains basic information on the process and some options for homebuyers.

A lender must submit a signed VA Form 26-0592 with every prior approval loan application. It is also necessary for lenders to certify that the loan was made in full compliance with the law.

One of the most interesting aspects of the form is the checklist. The form is designed to help military homebuyers identify energy-efficient improvements that can be installed on the property. This is a great way to save money.

Another noteworthy item on the form is the Energy Efficient Improvements option, which allows the borrower to add up to six thousand dollars to the total loan amount. Some additional features of the form include the counseling checklist, the pre-discharge claim exemption, and the VA funding fee exemption.

The Department of Veterans Affairs (VA) has coordinated with the Federal Home Loan Mortgage Corporation (FHLMC) to offer a guarantee on loans. As a result, a borrower can get a lower interest rate than a traditional mortgage.

The VA Form 26-0592 is merely one page long and is available as a PDF file. It has been updated to include information about recent changes to the VA home loan program.

VA Form 26-0592 – Counseling Checklist for Military Homebuyers

The VA Form 26-0592 is a formal document that contains the most important information about a new home purchase for active service members. This form will be filled out by a prospective buyer to obtain a VA loan. In addition to the usual disclosures, this document explains the latest and greatest in VA home loan policy.

The form is a PDF. It contains a small but significant amount of data. These include a few useful tips and tidbits, including an explanation of the new VA home loan program and the new rules of the game. Among other things, this document explains the Energy Efficient Improvements option, which allows for a $6,000 addition to your loan.

As part of the application process, you will also need to complete the home inspection checklist. If the home you are buying is in good condition, the VA may be able to help you out. However, if the home is not in good enough shape to pass VA inspection, you will be out of luck. You will also need to provide the MCC. Fortunately, the state of California has a homebuyer assistance program that helps veterans with mortgages.

On the subject of mortgages, you may have heard the old saying “the devil is in the details.” Well, this is true in the case of a VA loan. Aside from the obligatory paperwork, you will need a reputable lender and a good credit score.