VAFORMS.NET – VA Form 26-6381 – Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan – VA Form 26-6381 is a very important form that is filled out and submitted if you want to file for an assumption of liability. This type of filing is required by many types of businesses. If you have any experience with this form, you know that you will need to get it filled out and filed out quickly. You also know that it is important to make sure that your filing is correct. With this being said, you will need to read up on some important information before you fill out your file.

Download VA Form 26-6381 – Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan

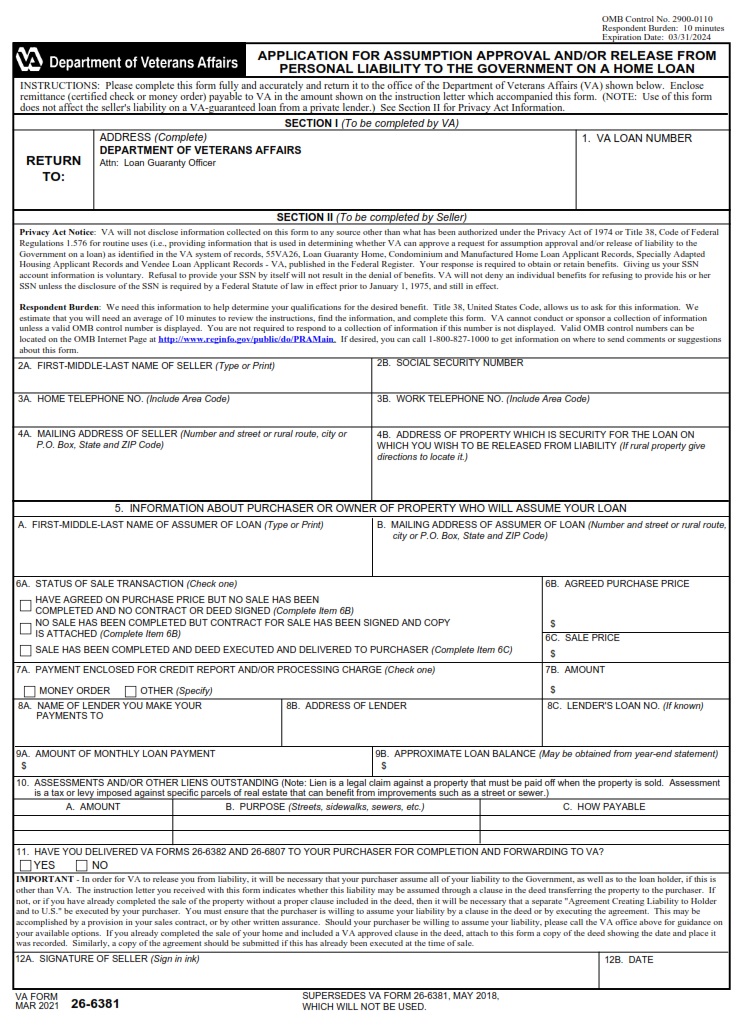

| Form Number | VA Form 26-6381 |

| Form Title | Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan |

| Edition Date | June 2022 |

| File Size | 813 KB |

VA FORM 26-6381 (1176 downloads )

What is a VA Form 26-6381?

If you are selling a property and the loan is a VA loan, you may need to fill out VA Form 26-6381. This form is necessary to determine whether or not the property is eligible for VA benefits. The data on this form is essential to determining the VA’s eligibility to grant the assumption.

Assuming a VA loan allows a qualified buyer to take over a borrower’s mortgage and sell a property. However, before doing so, you must meet certain requirements.

First, you must be a veteran. Second, you must meet the minimum credit and income requirements. Lastly, you must be able to meet all of the terms and conditions of the loan.

In some cases, a civilian buyer can assume a VA loan. In these instances, the new buyer will lose all of the VA benefits that were associated with the original loan. However, this option can be advantageous to both the buyer and seller.

Before assuming a VA loan, you must confirm that your lender will provide you with a release of liability. Your original lender will evaluate your agreement to ensure that you are releasing your liability in full.

When you have the required approval from your lender, you can complete VA Form 26-6381. You can do this online, by mail, or by fax.

Where Can I Find a VA Form 26-6381?

A VA Form 26-6381 is used to process a claim for a service-connected disability. It helps the VA assess a veteran’s eligibility for veterans’ benefits. The form has been designed for ease of use and is available in an easy-to-fill-out template.

The VA Form 26-6381 can be downloaded in a fillable format. You can also print and sign it. In addition to these options, you can also edit and share it with others using a secure workspace.

To fill out VA Form 26-6381, you will need to gather and review all the necessary information. These include medical records, statements from treating professionals, and information about a VA-related disability.

The information on the form will be useful in determining your entitlement and the approval of your VA loan assumption. However, you will not get your entitlement back once you have completed your assumption.

If you are a veteran, you may be eligible for a hardship waiver. This waiver can help you pay off your loan. For more information, check with your local VA office.

If you are a new buyer, you must meet certain income and credit requirements. In order to qualify for a VA mortgage, you must have a debt-to-income ratio that is less than 45%. Besides, you must be current on your loan and agree to assume all liabilities associated with it.

VA Form 26-6381 – Application for Assumption Approval and/or Release from Personal Liability to the Government on a Home Loan

If you’re looking for a legal document that can be filed online, you’ve come to the right place. The VA Form 26-6381 is an application to get an assumption approval. If you’ve got a hefty mortgage, you might be able to use this to help out, especially if you’re a veteran or are on the books. This form isn’t for the faint of heart, but you’ll get some good information and some nice tax breaks in the process.

There are actually many ways to fill out this form, including online and by mail. Be sure to read the instructions on the back. You’ll also want to include your receipts for any tax-deductible gifts you may have received. Lastly, take a few minutes to find out if you qualify for any VA-approved loan products. Once you’ve completed the application, a few hours of your time will be well worth your while. And if you’re lucky, you might actually see the inside of your mailbox.

While you’re at it, you might want to consider filing for a pension as well. It’s best to get a head start and find out what’s in store for you before you’re too late.