VAFORMS.NET – VA Form 26-8937 – Verification of VA Benefits – There are a few different VA forms that veterans can use to verify their benefits. One of these is the VA Form 26-8937. This is used to check the status of your VA disability benefits.

Download VA Form 26-8937 – Verification of VA Benefits

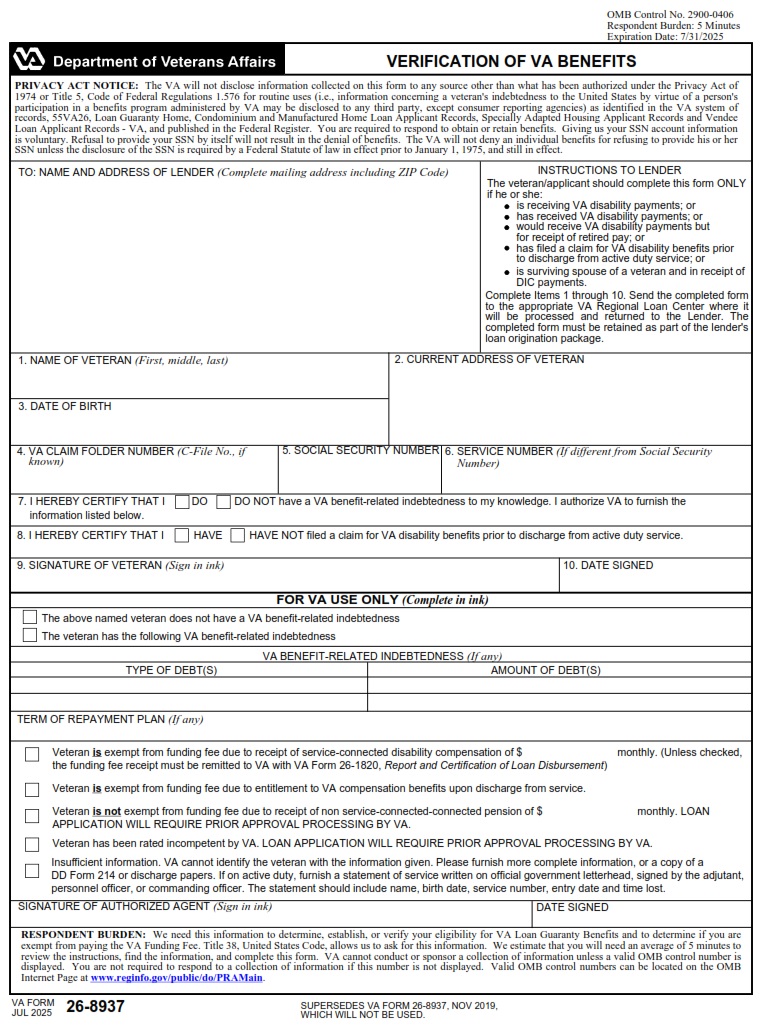

| Form Number | VA Form 26-8937 |

| Form Title | Verification of VA Benefits |

| Edition Date | July 2022 |

| File Size | 856 KB |

VA FORM 26-8937 (1829 downloads )

What is a VA Form 26-8937?

VA Form 26-8937 is a document used by lenders to determine if a veteran is exempt from the VA funding fee. Although it is a simple piece of paper, it is one of the most important forms a lender can use.

The form contains a number of fields, including a few that are particularly useful. It can be completed in as little as 30 minutes. You will need to complete the top half of the form before you submit it to your lender. After the form is filled out, you will need to keep it as part of your loan origination package.

There are a number of other documents that are required before you can get approved for a VA loan. These include official identification, a DD 214 or discharge papers, and a Statement of Service. Your statement of service should include details such as your name, birth date, service number, and entry date.

The VA has taken note of this requirement and has developed a new process for submitting the form. In the new system, you will need to upload it to WebLGY. Using this system, you will also be able to send an e-mail version of the form to your lender.

The most important thing to remember is that the VA will not process the form unless you meet certain exceptions. This means you should only fill out the form in cases where it is truly necessary.

Where Can I Find a VA Form 26-8937?

VA Form 26-8937 is a form designed to help lenders check the debt status of a Veteran. It also serves to inform lenders about certain exemptions.

In particular, the form is intended to verify that a Veteran is eligible for the VA disability benefits he or she is entitled to. The information on the form is not disclosed to the general public and is only used by the lender and VA to perform the debt check.

If a veteran is seeking compensation for a service-connected disability, he or she will need to fill out VA Form 26-8937 and provide it to the lender. Once a lender has the necessary information, the loan examiner will review the form and make a determination about the Veteran’s eligibility.

While VA Form 26-8937 is not required by Circular 26-21-03, it is often used to inform lenders about exemptions. Borrowers who are able to prove a service-connected disability may be able to save money on their mortgage.

Depending on the type of VA loan you are applying for, you may need to submit a Certificate of Eligibility (COE) to the lender. The COE can be obtained online, via mail, or through your lender.

VA has made a number of enhancements to the COE, which are intended to provide greater certainty to lenders regarding the ability to collect funding fees from eligible Veterans. However, you should still obtain a new COE for each VA loan transaction.

VA Form 26-8937 – Verification of VA Benefits

VA Form 26-8937 is a document that helps lenders check a VA-backed loan applicant’s debt history. This form can be obtained through the loan applicant’s lender or online through the VA website. It is not required in every case, but in some cases, it is needed.

VA has enhanced the COE to make it easier to obtain the COE for eligible Veterans. Specifically, the changes reduce instances where lenders must verify a Veteran’s income.

Lenders can upload the completed VA Form 26-8937 to WebLGY. Lenders can also submit the form by e-mail. In these circumstances, the Lender Guaranty Service will collect the information and send it to the OMB for review.

VA also recently announced that faxed copies of VA Form 26-8937 will no longer be accepted. This change is due to a move to streamline the loan process.

The COE is a document that indicates that a Veteran is eligible for a VA-backed loan. When a Veteran receives a COE, his or her lender will be able to rely on the COE to determine whether the Veteran has been receiving disability payments. Upon receipt of a COE, the funding fee will be removed from the total cost of the VA-backed loan.

To obtain a VA loan, a borrower should begin the application process early. By doing so, the borrower may save up to $10,800 on a $300,000 mortgage.

VA Form 26-8937 Example