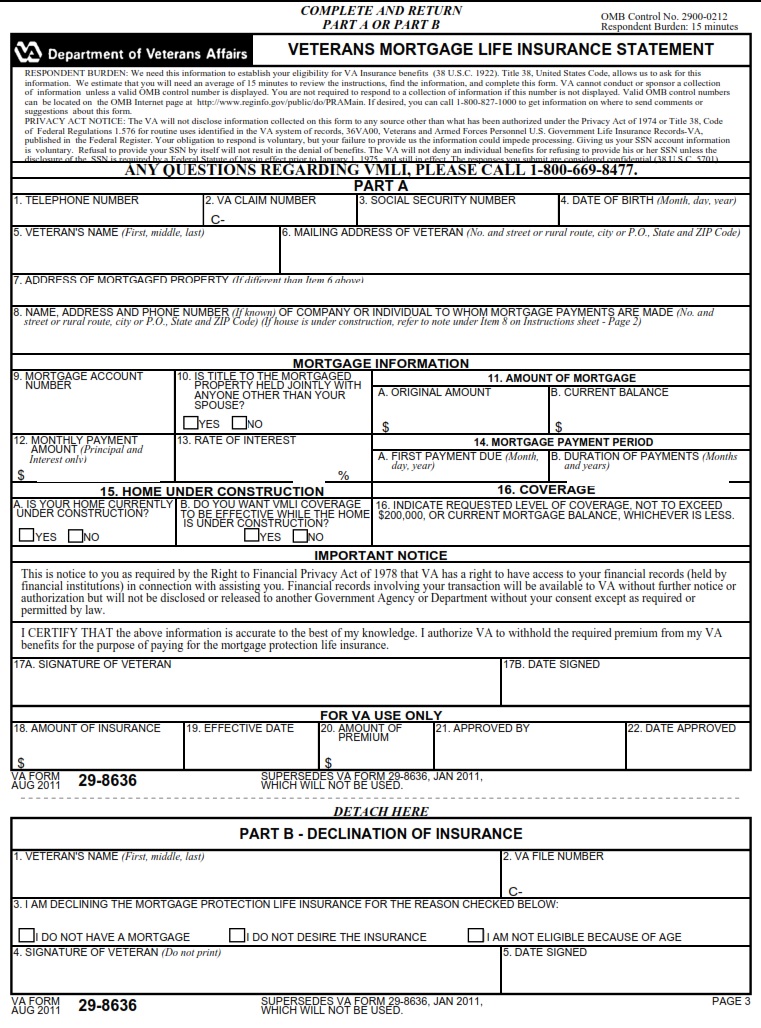

VAFORMS.NET – VA Form 29-8636 – Veterans Mortgage Life Insurance Statement – The VA Form 29-8636 is the application that you need to file if you are a veteran looking to take out a mortgage. There are a few things that you should keep in mind when it comes to this form.

Download VA Form 29-8636 – Veterans Mortgage Life Insurance Statement

| Form Number | VA Form 29-8636 |

| Form Title | Veterans Mortgage Life Insurance Statement |

| Edition Date | Aug 2011 |

| File Size | 58 KB |

VA FORM 29-8636 (1320 downloads )

What is a VA Form 29-8636?

If you’re interested in applying for the Veterans Mortgage Life Insurance program, you’ve probably heard of the VA Form 29-8636. This is a streamlined version of a similar form that is used around the country. However, it isn’t as straightforward to fill out as it seems. The process requires a bit of patience and a solid grasp of English.

To apply for VMLI, you first need to get your mortgage account statement from your lender. You’ll then need to present this in your application. In addition, you’ll also need to include a truth-in-lending statement and a settlement statement. These documents are important because they’ll be used to determine your eligibility for VMLI.

The VMLI program is one of the most popular programs offered by the VA. Applicants can expect to see their premiums paid out as a percentage of their monthly compensation. That said, if you’re looking for a more traditional life insurance policy, you might want to consider the VA’s Term Life Policy.

While the VMLI may be the best-known program, the VA’s Survivors and Dependents Insurance Program can be equally rewarding. This program provides coverage to beneficiaries of Veterans who die or become disabled because of their military service. Its main benefit is that the proceeds are payable to the surviving spouse, children, or other designated beneficiaries.

Where Can I Find a VA Form 29-8636?

VA Form 29-8636 is a form designed to help veterans get mortgage life insurance. This type of insurance is available for those who suffer from a terminal illness or disability. The information on this form is required by 38 U.S.C. Section 806.

You can find this form online. In fact, the fastest way to submit a form to the VA is via the VA Document Upload web page. After you create an account, you can upload a variety of documents, including the Va Form 29-8636.

If you have a device with the Adobe Acrobat Reader software, you can fill out the form and print it out. Adobe Acrobat Reader is free to download. Alternatively, you can use a commercial PDF reader, such as Microsoft Office.

You can also edit and modify the form with the help of the Va Form 29-8636 template. The template is equipped with advanced editing tools to guide you through the process. These include watermarks, a lock feature, a merge feature, and a split feature. It’s also got a step-by-step guideline.

However, the real beauty of the Va Form 29-8636 is how it’s integrated into the online template. To make things even easier, there’s an app that allows you to add, edit, and share your documents. With this app, you can even sign your forms electronically.

VA Form 29-8636 – Veterans Mortgage Life Insurance Statement

Veterans Mortgage Life Insurance (VMLI) provides protection to severely disabled veterans who have a home mortgage. VMLI covers up to $200,000 of the outstanding balance on the mortgage. It is not payable to surviving family members. This insurance is available for both new and existing mortgages.

VA Form 29-8636 is a form to apply for VMLI. In order to apply, you must provide information about your current mortgage. You may also need to submit a truth in the lending disclosure statement.

The premium for VMLI varies from individual to individual. It is dependent on a number of factors including age, your age at the time of applying, and the time remaining on your mortgage. If you want to get a better idea of what your premium would be, you can use a premium calculator.

To learn more about VMLI, you can contact the VA or go to the Veterans Affairs website. You can also fax or mail documents to the VA. These documents include your current mortgage account statement, a truth-in-lending disclosure statement, and a settlement statement.

When you have completed your application, you will be notified by the VA whether or not you are eligible for VMLI. You will have one year to appeal to the Board of Veterans’ Appeals. If you are rejected, you can appeal to the federal district court.