VAFORMS.NET – VA Form 26-8497a – Request for Verification of Deposit – The VA Form 26-8497a is known as the Request for Verification of Dep. It is a form that must be completed by an eligible veteran to prove that he or she is entitled to disability benefits. This can help an applicant avoid denials or delays in receiving benefits.

Download VA Form 26-8497a – Request for Verification of Deposit

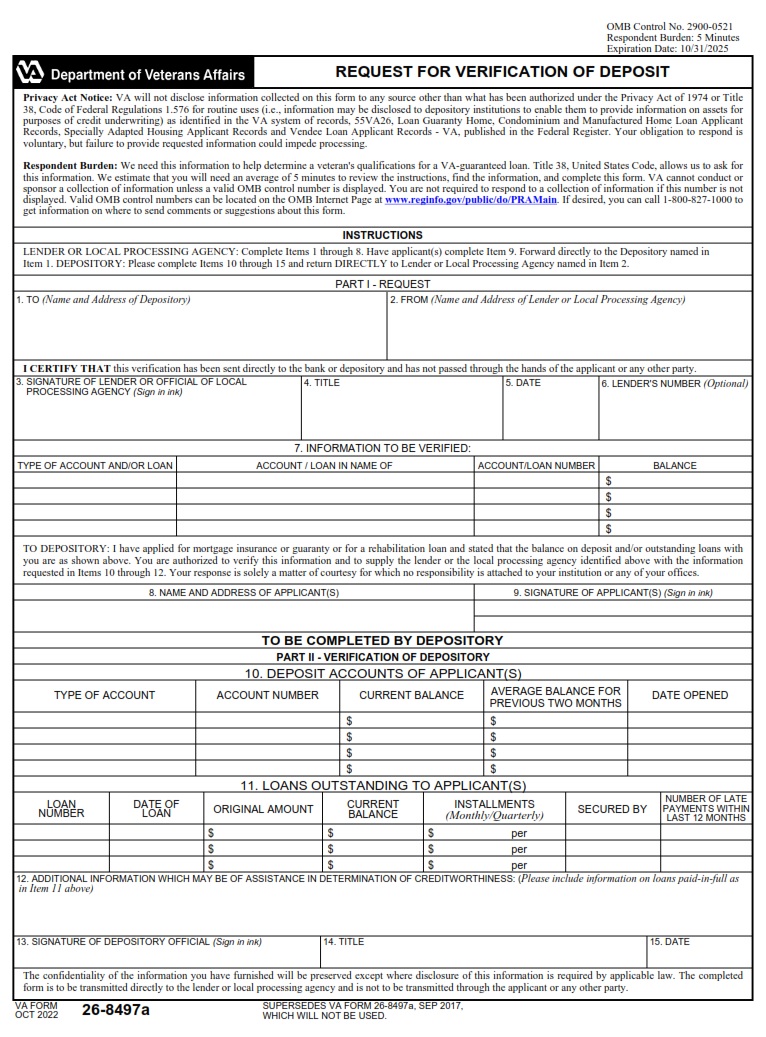

| Form Number | VA Form 26-8497a |

| Form Title | Request for Verification of Deposit |

| Edition Date | October 2022 |

| File Size | 817 KB |

VA FORM 26-8497A (1508 downloads )

What is VA Form 26-8497a?

If you are a prospective borrower, be sure to fill out a VA Form 26-8497a. This is one of the many required documents for any loan application. You will find that these are used to validate your credentials and to help you find the best rates. In addition to the standard credit card information, you may be asked for personal financial details such as bank account balances, Social Security numbers, and employer contact information. As with any other loan, it is important to ensure your VA loan application is accurate and on time. There are some benefits to submitting this kind of information, such as a lower interest rate, and a faster processing time. Of course, you must remember to read the fine print. Otherwise, you could wind up with a loan with a higher interest rate and a shorter payment term. It is also recommended that you do not apply for a mortgage if you have any doubts about your ability to make timely payments.

Whether you are taking out a new loan or refinancing an old one, you will likely be prompted to fill out a form. However, you can take comfort in the fact that these documents are standardized and your information is protected. That said, the most challenging part of the process is making sure you provide the most up-to-date information possible.

Where Can I Find a VA Form 26-8497a?

VA Form 26-8497a is a required document for lenders when they are processing an insured or guaranteed loan. The document is used by the lender to ensure that the information supplied by the applicant is correct. It takes only five minutes to complete and requires the submission of one hundred and thousand responses.

Before completing this form, a lender must verify that the applicant has a valid attorney-in-fact. An attorney-in-fact is an individual who represents a veteran unless the veteran chooses to retain another attorney.

Lenders must also submit a request to the VA for an underwriter’s analysis. This must be completed before closing the loan.

Lenders must comply with all requirements, including maintaining all required documents. If a change is made, the lender must notify the VA in writing.

If the lender fails to comply with this requirement, the VA may deny the guarantee. In addition, the lender must wait until all facts are clear before closing.

The VA loan guaranty procedure has been updated to include a modified submission process. Applicants may now submit their request electronically through a web-based Loan Guaranty system.

Section 3 of chapter 7 contains special underwriting requirements. The lender must establish a reasonable value for the property. They also must pay a funding fee.

VA Form 26-8497a – Request for Verification of Deposit

The Veterans Benefits Administration (VBA) is a division of the Department of Veterans Affairs. Its mission is to help veterans secure their benefits. Some of its more popular programs include the VA Home Loan Guarantee Program and the Interest Rate Reduction Refinancing Loan program. They are also responsible for the collection of certain types of information on applicants. These may include details on your military service, your employment history, and your debt-to-income ratio.

VA forms are used by lenders to ensure that they are underwriting VA loans in a reasonable fashion. One of the best examples is the VA Form 26-8497a – Request for Verification of Department. This form is required by lenders making guaranteed and insured loans. Lenders are not allowed to charge an attorney’s fee or other such fees. However, a funding fee must be added to the loan principal. Alternatively, the borrower can pay for title examination work or pay the nominal fees.

In addition, there is also a VA Form 26-1820. This form is used by lenders to close VA-guaranteed loans. It has several fields already in place, but it has a few new ones to be added in. Among the new fields is a certification that is not for the faint of heart.

VA Form 26-8497a Example