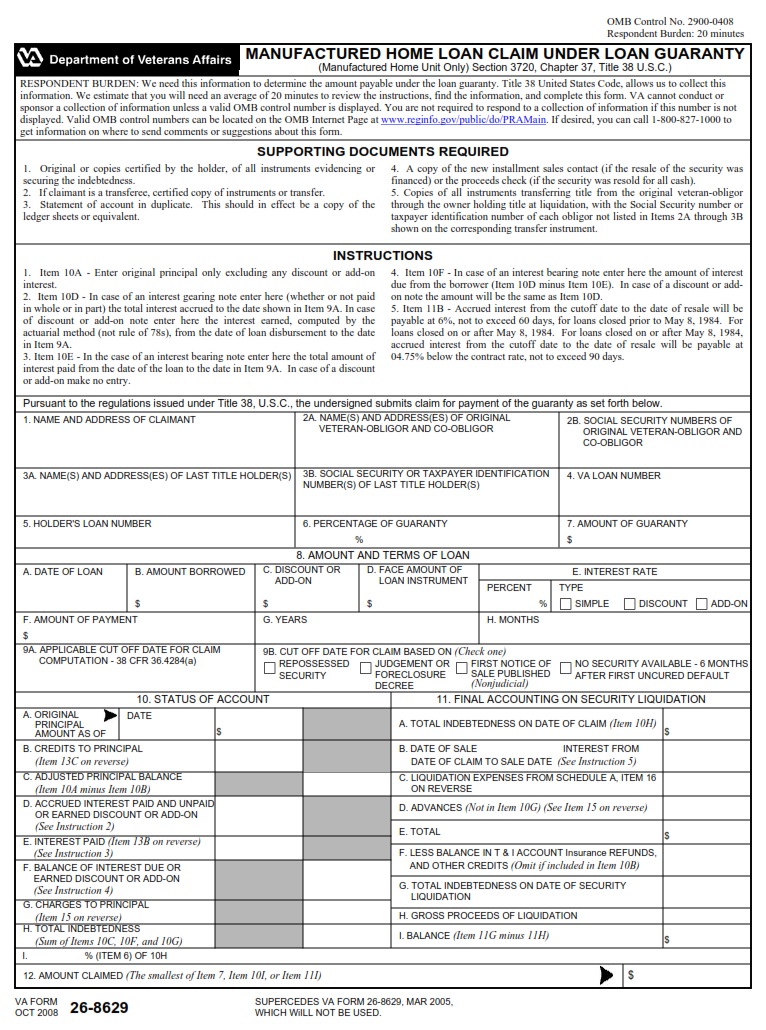

VAFORMS.NET – VA Form 26-8629 – Manufactured Home Loan Claim Under Loan Guaranty – If you’re interested in obtaining a manufactured home loan, you’ll need to fill out VA Form 26-8629 to submit your application. This form helps you to determine if you qualify for a VA loan and how much you’ll pay. Before you fill out this form, however, you should read up on the requirements so you know exactly what to expect.

Download VA Form 26-8629 – Manufactured Home Loan Claim Under Loan Guaranty

| Form Number | VA Form 26-8629 |

| Form Title | Manufactured Home Loan Claim Under Loan Guaranty |

| Edition Date | June 2022 |

| File Size | 744 KB |

VA FORM 26-8629 (219 downloads )

What is a VA Form 26-8629?

If you are a veteran or a spouse of a veteran, you may have heard of VA Form 26-8629. The form has been in existence for over a decade and is now utilized nationwide. Essentially, it is the legal form that a lender requires in order to process a claim on a combination loan. It is the simplest form to fill out, and the most likely to yield a positive result. You should read the instructions carefully, and follow them to the letter. Basically, you are required to include the initial principal, as well as several other pertinent data points.

In addition to announcing the arrival of the form, the Department of Veterans Affairs also introduced a training webinar on the same subject. If you want to know more about the form, check out the link below.

Where Can I Find a VA Form 26-8629?

When it comes to a VA loan, it’s a good idea to get as much information as possible. If you want to be sure that you’re getting the best deal on a VA home loan, you need to understand what you’re getting into before you sign up for one. Fortunately, there are several resources to help you determine the right loan for you.

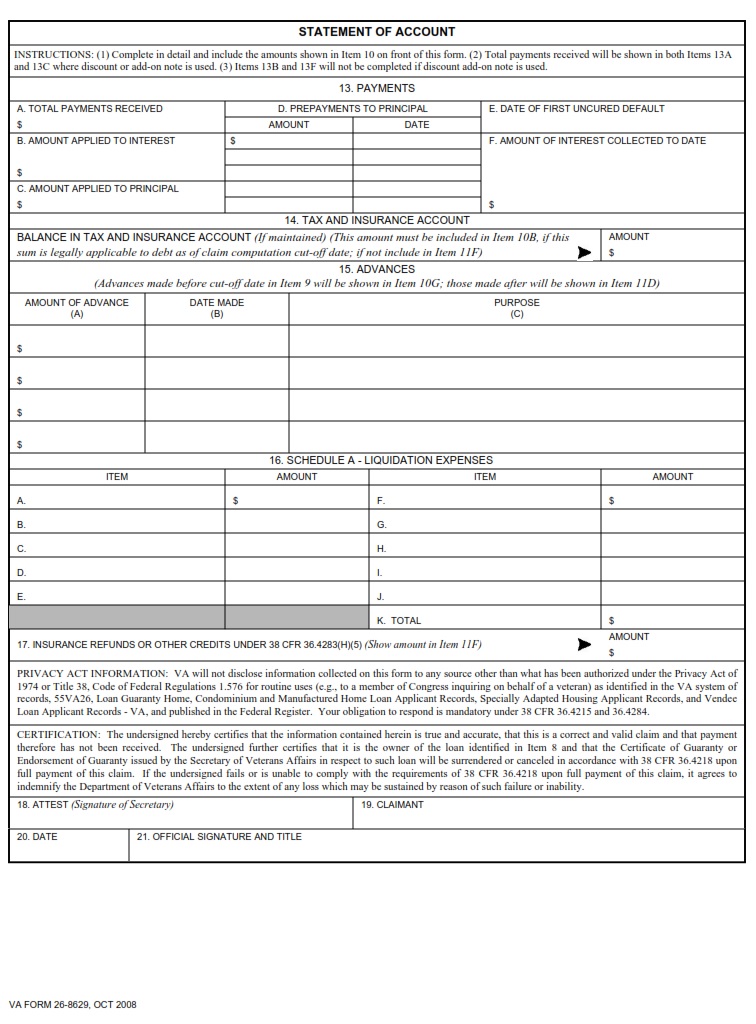

One of the most important and useful tools in the VA home loan arsenal is VA Form 26-8629. This is a small form, but the information it contains is valuable to any homeowner. It’s actually a legal document that’s used as a prerequisite for payment claims on combination loans. The form is available in a variety of formats, from PDF to Word to Excel. In addition to the form itself, you’ll also need supporting documentation such as copies of ledgers. And finally, if you’re a surviving spouse of a Veteran, you’ll need to make sure that you can prove that you’re eligible for a VA home loan.

VA Form 26-8629 – Manufactured Home Loan Claim Under Loan Guaranty

If you hold a VA-guaranteed manufactured home unit that was foreclosed, you will need to fill out VA Forms 26-8629 and 26-8630. These forms provide data to the VA, which will be used to determine your claim payment. The data will include accrued interest, claim balance, and various expenses associated with the liquidation of the loan. This information is required by section 3712 of chapter 37 of title 38 U.S.C. Also, proof of service is required for persons who entered service after September 7, 1980.

Specifically, this form is used as a prerequisite for the payment of claims for terminated combination loans. Data collected through this form includes information on the number of days the loan was in arrears and the total amount owed. In addition, data on any discounts that were awarded to the holder and the interest rate that was applied are also provided.

VA Form 26-8629 was initially introduced by the Department of Veterans Affairs on October 1, 2008. Since then, it has become widely accepted across the United States. To learn more about this form, visit the website of the VA. You can also download the form on the VA’s website.

When filing a manufactured home loan claim, you should make sure you are accurate in your information. VA’s systems will verify your information, but you will also need to supply specific details in your VA Form 26-8629.

VA Form 26-8629 Example