VAFORMS.NET – VA Form 26-8923 – Interest Rate Reduction Refinancing Loan Worksheet – If you are a veteran of the military, you may qualify for an interest rate reduction refinance. This can be done by filling out VA Form 26-8923. Having this form on hand will make the process of applying for this loan much easier. The VA will then review your application, and if it meets all of its requirements, you will receive an approval letter. In most cases, the loan will be processed within a day or two. However, in some instances, it can take up to two weeks for the VA to approve your request. So it is important that you get your form as soon as possible.

Download VA Form 26-8923 – Interest Rate Reduction Refinancing Loan Worksheet

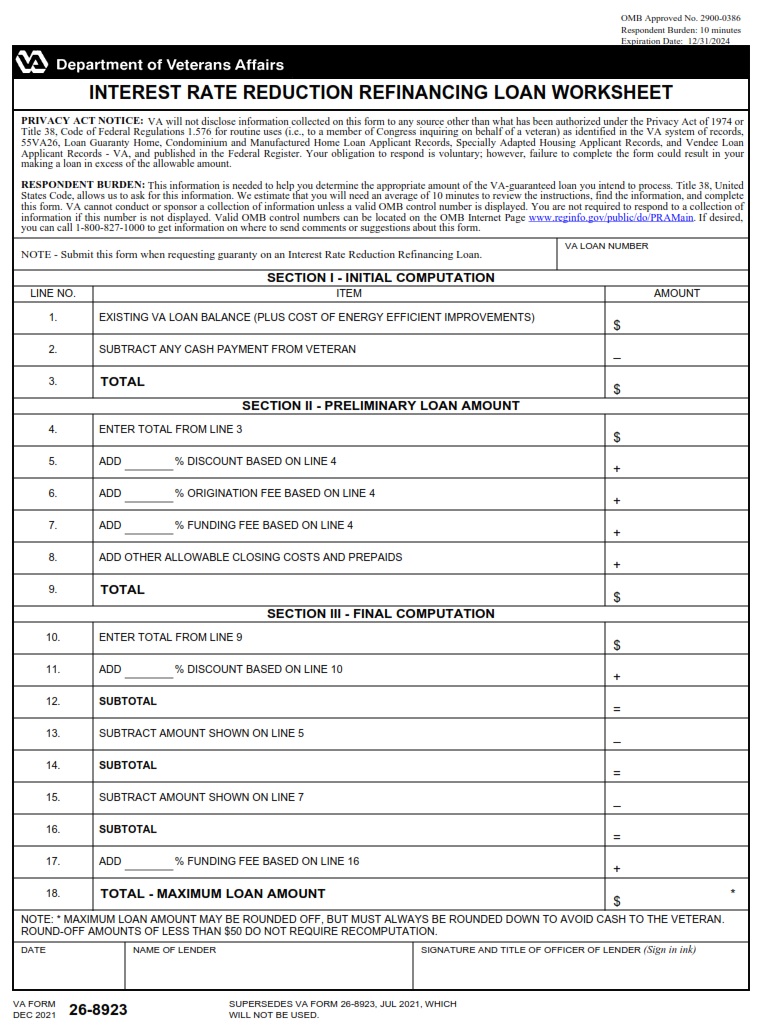

| Form Number | VA Form 26-8923 |

| Form Title | Interest Rate Reduction Refinancing Loan Worksheet |

| Edition Date | June 2022 |

| File Size | 780 KB |

VA FORM 26-8923 (724 downloads )

What is a VA Form 26-8923?

The VA Form 26-8923 is a tad pricier than a cup of tea but is well worth the splurge. If you’re a Veteran, a spouse, or a senior citizen, this little paper will provide a great deal of insight into your options. In the end, you will be able to make a much better decision.

This one-page form is the perfect place to start. Fill it out to your heart’s content and then export it to your preferred format. You can print it, share it via email, or upload it to the cloud. And if you have the time, you can even rearrange its pages to suit your needs.

Of course, the real fun comes from the experience of comparing lenders and plans. That’s where a professional can come in. They can show you the best options, including VA streamlined refinancing and conventional refinancing. However, there are a few things you’ll want to keep in mind before you make your decision.

One of the more obvious things you should do is find a lender who has good rates, offers all the amenities, and has a solid reputation. Another consideration is the VA funding fee. These fees are levied on every transaction involving a VA loan.

Where Can I Find a VA Form 26-8923?

When it comes to a VA home loan, one of the more common refinancing options is the interest rate reduction refinancing loan (IRRRL). This type of loan, also known as an IRR, allows borrowers to borrow against their existing VA loan at a lower interest rate, resulting in a lower monthly payment. The process is not as daunting as it may sound.

Before deciding on the best lender for your VA Streamline Refinance, take the time to learn about the requirements. Aside from the loan itself, you’ll need to prove that you are a bona fide resident of an investment property. You can do this with a mortgage statement, bank statement, or even pay stubs.

One of the easiest ways to get this information is to fill out VA Form 26-8923. In fact, you can find this form online. It contains a variety of useful information. Most of it is aimed at helping veterans and their dependents make informed decisions. For example, you can see how much interest you can save by taking out a new loan and the cost of a rollover.

One of the coolest features of this form is that you can download it and send it to your email address. Also, you can export it to the cloud if you choose.

VA Form 26-8923 – Interest Rate Reduction Refinancing Loan Worksheet

Interest rate reduction refinancing loans are a great opportunity for veterans to lower their monthly payments. However, many veterans are curious about the breakeven point of VA IRRRLs. The Department of Veterans Affairs has recently proposed a rule change to help clarify this issue. This proposed rule would require lenders to provide certain information in prescribed formats.

In addition to a breakeven point, the rule also clarifies the formula that enables a veteran to make a maximum loan. This maximum is based on the loan balance and allowable fees. It is also calculated as the cost of energy-efficient improvements.

Under the new rule, prepaid interest, closing costs, and financed funding fees are subtracted from the numerator. These expenses can be either paid by the veteran or the lender. They are then recalculated to determine the maximum loan amount.

Lender credits are also accounted for in the recoupment calculation. These are not required, though, if the discount points are paid with cash. Rather, the VA believes that lenders should provide evidence of the discounted rate being due to credit.

This proposal is an attempt to implement the statutory interest rate safeguard for IRRRLs. If the interest rate falls below the minimum rate, then the recoupment is reduced.

VA Form 26-8923 Example