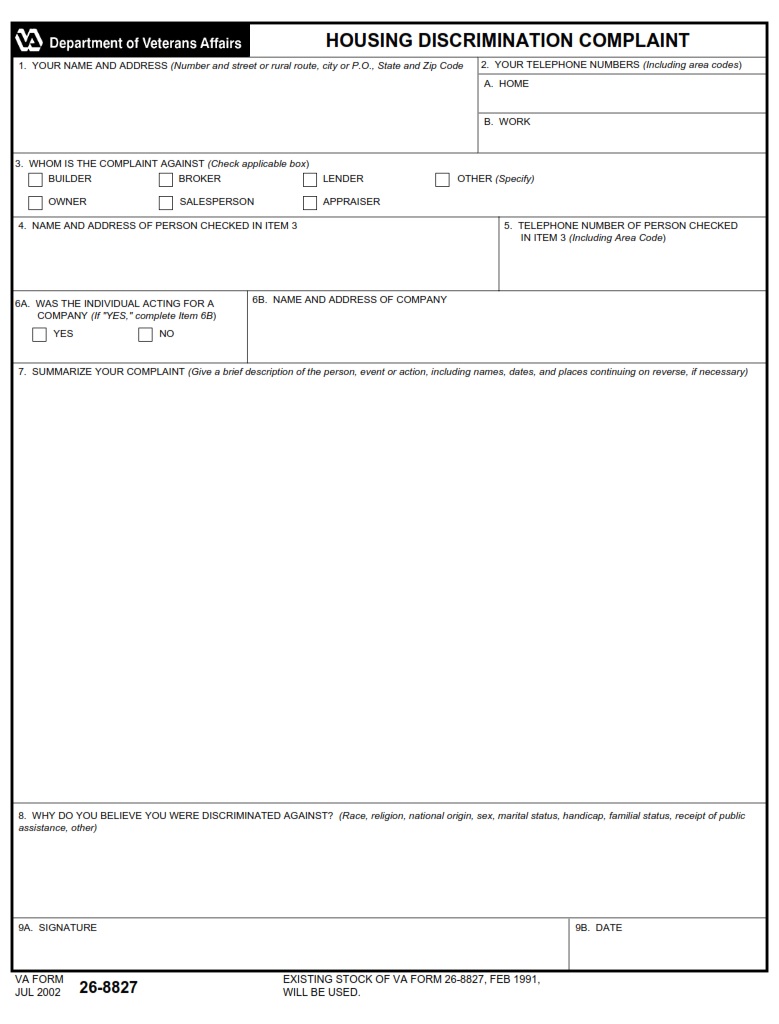

VAFORMS.NET – VA Form 26-8827 – Housing Discrimination Complaint – VA Form 26-8827 is a form used to make a complaint of housing discrimination. This type of discrimination complaint is usually filed by veterans who are applying for a home or apartment. When you fill out the VA form, you are also supposed to file a copy of your application for the home or apartment. The VA will usually have an office in your city where you can pick up the form. You can also fill out a form online.

Download VA Form 26-8827 – Housing Discrimination Complaint

| Form Number | VA Form 26-8827 |

| Form Title | Housing Discrimination Complaint |

| Edition Date | June 2022 |

| File Size | 601 KB |

VA FORM 26-8827 (166 downloads )

What is a VA Form 26-8827?

VA Form 26-8827 is a form that you can use to lodge a complaint regarding housing discrimination. The VA office that you contact will investigate the claim. It is important to include the names of all parties involved, the date of the alleged discrimination, and the property address.

A VA loan is available to veterans who are eligible for the program. These loans can be used for a number of purposes, including the purchase of a house, the payment of other liens on the home, or the addition of energy-efficient improvements. Depending on the purpose, the maximum amount of money that can be borrowed with a VA loan is 90 percent of the appraised value of the property.

VA Loans can be used for purchasing property in the United States, Puerto Rico, Guam, and other possessions. However, there are restrictions on the amount of guarantee that can be provided. This guarantee cannot exceed 40 percent of the total loan amount.

You may be eligible for a VA loan if you are a veteran or a spouse of a veteran. You must meet service eligibility criteria and you must have served at least 24 months of active duty. In addition, you must have been discharged under honorable conditions or be a service-connected disability.

Where Can I Find a VA Form 26-8827?

If you’re a veteran, you may be able to purchase your dream home with the help of a VA loan. However, there are some things you should know before you apply for one.

First of all, you’ll need to ensure you have enough credit to qualify. You also need to be able to prove you can afford the house. For example, you may be able to borrow up to 90 percent of the value of the property.

When applying for a VA loan, you should also ensure you have all the necessary documentation. Most lenders will help you fill out the application.

Once you’ve completed your application, you’ll need to submit it to your local VA office. They’ll determine your eligibility and provide you with a certificate of eligibility.

It’s important to note that a certificate of eligibility does not guarantee your VA loan will be approved. The decision can take up to six weeks.

During this time, you should not expect to move in before the loan is approved. Your lender will be the most informed about any developments.

VA loans are offered for a variety of purposes, including buying and fixing up a house, installing solar heating systems, or repairing a home that was damaged by fire. These loans are available to active duty service personnel and their spouses.

VA Form 26-8827 – Housing Discrimination Complaint

If you have experienced discrimination in the housing market, you may want to file a complaint with your local VA office. The department’s Housing and Civil Enforcement Section enforces the Fair Housing Act and the Equal Credit Opportunity Act.

To make a claim under the Fair Housing Act, you will need to fill out VA Form 26-8827. This form is available at your local VA office. It is estimated to take about 15 minutes to fill out. You will be contacted by a fair housing specialist to further discuss the complaint.

The Fair Housing Act is designed to prevent discrimination against members of a protected group. Specifically, it prohibits housing discrimination based on race, gender, or disability.

There are many different types of discrimination you can experience in the housing market. For example, a lender’s refusal to make a loan to a disabled veteran is illegal. Likewise, a landlord’s refusal to accommodate a disabled tenant is also unlawful.

The Department of Veterans Affairs ensures that everyone who is eligible for its assistance has an equal opportunity to buy a home. However, the agency can’t guarantee a good investment. A lender may need to be held accountable for violating the law.

VA Form 26-8827 Example