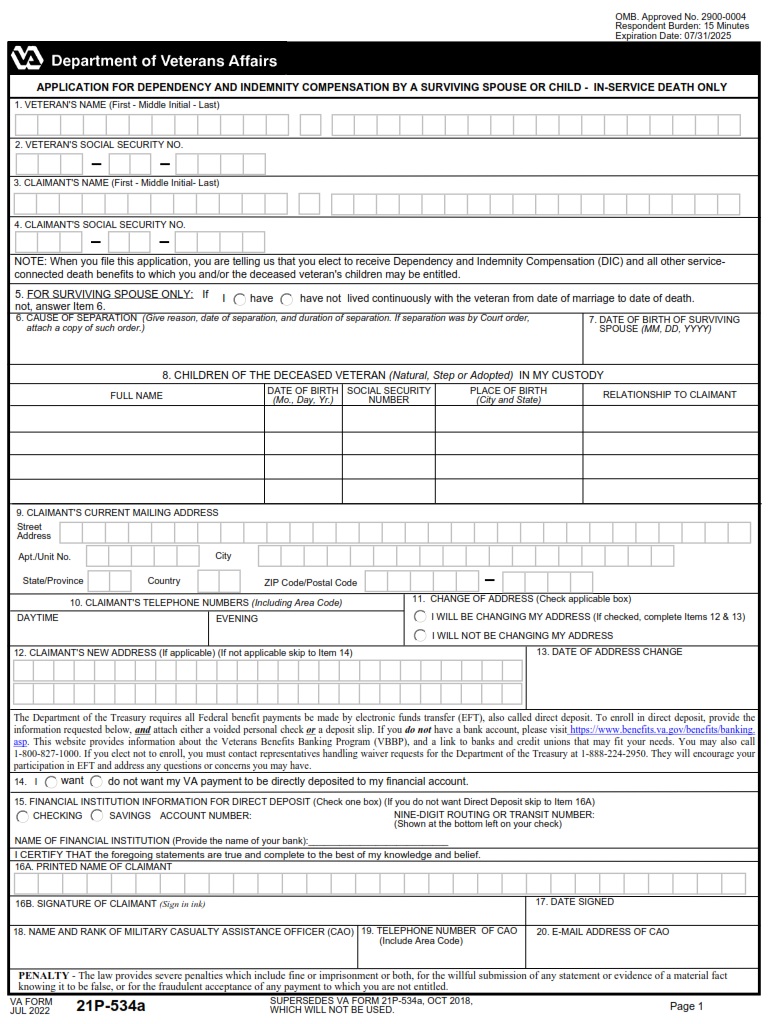

VAFORMS.NET – VA Form 21P-534a – Application for Dependency and Indemnity Compensation by a Surviving Spouse or Child—In-Service Death Only – Those who are eligible to receive VA benefits must fill out VA Form 21P-534a. This form is a document that is used for requesting the benefits of dependency and indemnity payments. It is usually filed with a VA attorney. It contains information about the veteran’s income, assets, and dependents.

Download VA Form 21P-534a – Application for Dependency and Indemnity Compensation by a Surviving Spouse or Child—In-Service Death Only

| Form Number | VA Form 21P-534a |

| Form Title | Application for Dependency and Indemnity Compensation by a Surviving Spouse or Child—In-Service Death Only |

| Edition Date | November 2022 |

| File Size | 2 MB |

VA FORM 21P-534A (260 downloads )

Where Can I Find a VA Form 21P-534a?

Whether you’re a veteran or a surviving spouse of a veteran, you can apply for a VA Survivor’s Pension. This tax-free payment is designed for unmarried, low-income surviving spouses of wartime veterans. Depending on your financial status, you may qualify for a higher or lower payment.

The VA has implemented new regulations that mandate the use of standard claim forms. This includes VA Form 21P-534, which is used by surviving spouses of veterans. This form is also used for Fully Developed Claims (FDC) and Parent’s Disability Indemnity Compensation (DIC) claims.

VA Form 21P-534A is a shortened application for DIC payments. DIC payments to surviving spouses are payable for life. These payments are a supplement to other surviving spouse benefits.

The most important part of this form is the Aid & Attendance Worksheet. The worksheet must contain all medical and household expenses, sources of income, and assets. The worksheet is also required to be filed at the VA office. This information will be used to determine your allowance for pension benefits. The Aid & Attendance Worksheet must be filled out by the veteran and spouse.

The VA may disclose your Social Security number as required by Federal Statutes in effect before January 1, 1975. This is required because the Department of Veterans Affairs may use your Social Security number to determine your eligibility for benefits or to collect the money you owe. This information may also be used by the VA for personnel administration, research, or litigation in which the United States is involved.

VA Form 21P-534a – Application for Dependency and Indemnity Compensation by a Surviving Spouse or Child—In-Service Death Only

Survivors of Veterans can apply for benefits through the Department of Veterans Affairs. They can receive compensation for the death of a service-connected or non-service-connected Veteran. This is a tax-free monthly benefit, and it is paid to eligible survivors. Survivors can also receive benefits for the death of a dependent child.

The VA Form 21P-534 is an eight-page document that is designed to help surviving spouses and children apply for VA benefits. It is available in both paper and digital versions. The digital version can be filled out online. However, a printout is also needed.

The first part of the VA Form 21P-534 requires personal information about the Veteran, including his date of birth and date of entry into active service. The VA also asks for a social security number. The applicant’s gross income is also required. The income limit must be in line with the income limits of the state. The VA also pays a pension based on family income and assets.

The second part of the VA Form 21P-534 focuses on dependents. The dependents must be aged eighteen or under. The VA will also require a birth certificate of the child. The children’s wages are not considered in the income limit. The VA pays a pension based on the number of dependent children.