VAFORMS.NET – VA Form 21P-8416 – Medical Expense Report – Whenever you need to submit a VA Form 21P-8416, there are a few steps that you need to follow to ensure that you are properly filing the form. These steps will help ensure that you are properly documenting your medical expenses. This will ensure that your VA benefits are paid to you on time.

Download VA Form 21P-8416 – Medical Expense Report

| Form Number | VA Form 21P-8416 |

| Form Title | Medical Expense Report |

| Edition Date | April 2022 |

| File Size | 2 MB |

VA FORM 21P-8416 (181 downloads )

What is a VA Form 21P-8416?

Getting the best deal on veterans’ benefits requires a bit of legwork. Fortunately, the VA has created an online tool for navigating the weeds. It can be used to file for a variety of benefits, from healthcare to veterans’ housing. It’s a good idea to familiarize yourself with the site before you head out on your own, so you know exactly what to expect when the time comes to file a claim.

The site also makes it easy to import and export forms from one account to another. The site’s aficionados can drag and drop form pages from one device to another, and delete or add new fillable fields as the need arises. If you’re ready to take the plunge, you can create a free account. Once you’ve logged in, you can use the site’s form editor to make minor tweaks, such as adding an image or a new fillable field. Alternatively, you can mail your form to a local VA benefits office.

The site also makes it easy to export the forms you’ve filled out to the cloud. The site also provides a secure, password-protected URL that lets you import other forms from other sites. It’s a great way to share forms with your colleagues and loved ones, and you can add a few to your own vault as well.

Where Can I Find a VA Form 21P-8416?

Besides the usual VA benefits, you can apply for a tax-free, monetary benefit called the Veterans Pension. This is a benefit that is available to wartime Veterans who meet certain age and non-service-connected disability requirements. The maximum annual rate is set by Congress.

For more information, visit the VA website. You can also contact the Harris County Veteran Services Officer.

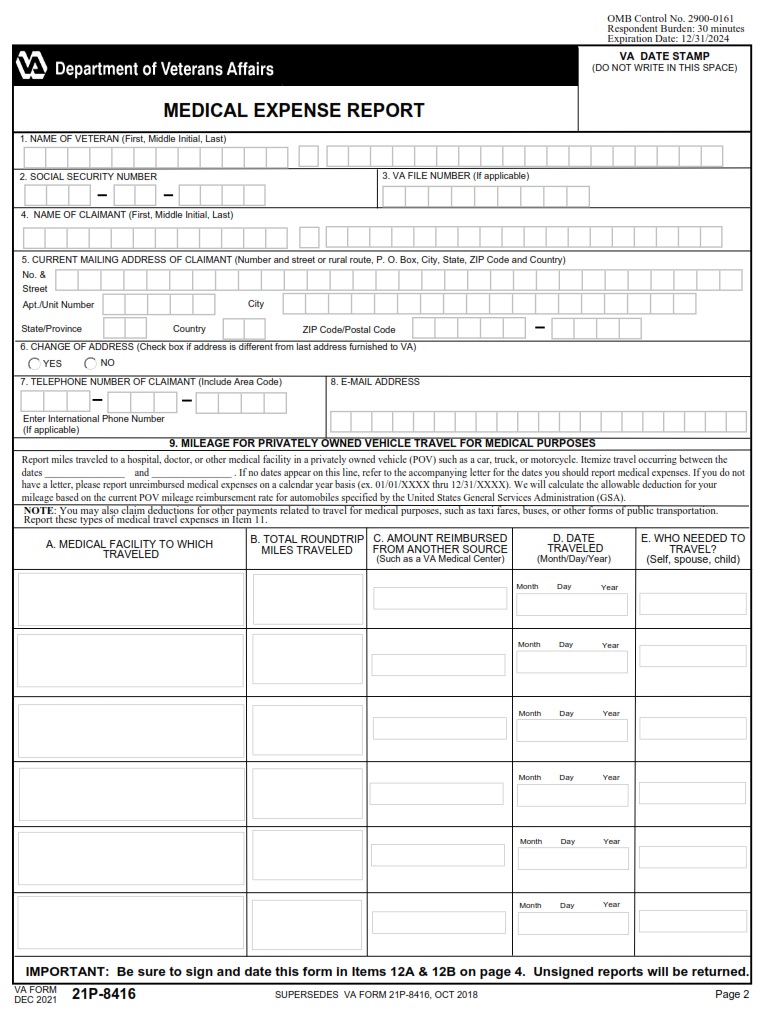

The VA medical expense reimbursement form requires a lot of information, such as the name of the claimant, social security number, and doctor or hospital. It also requires details about the expenses, including the actual amount, date of payment, and purpose of payment.

You must report your medical expenses as soon as possible. This is to avoid having your benefits reduced. VA officials are responsible for deciding whether or not you qualify for benefits.

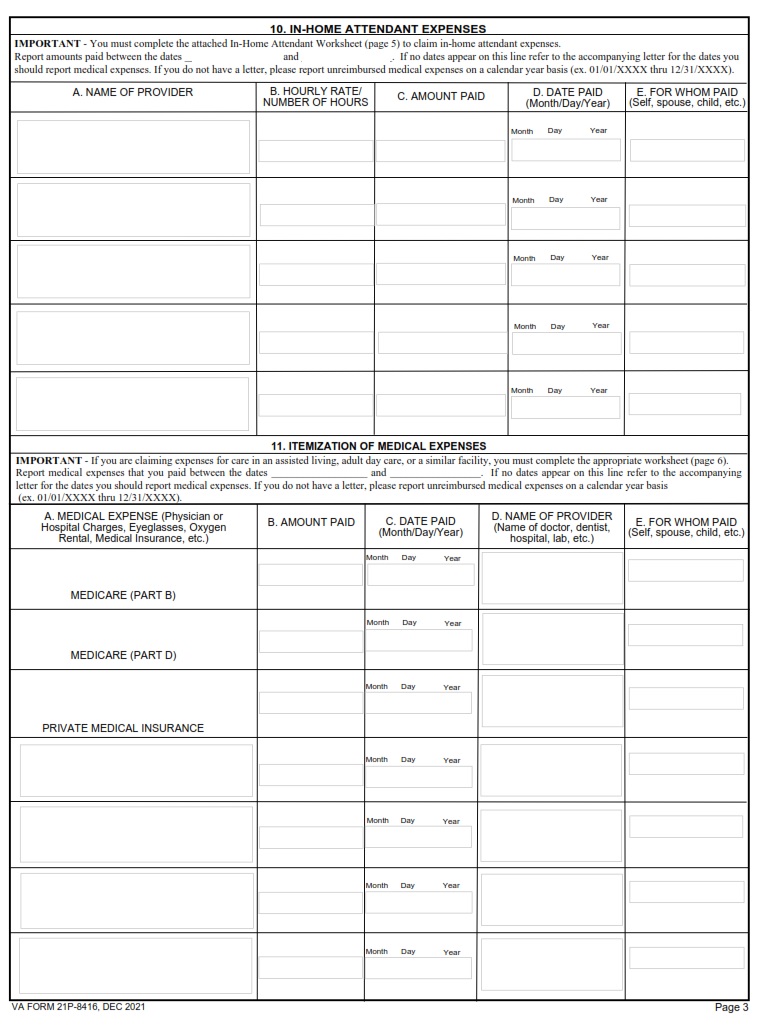

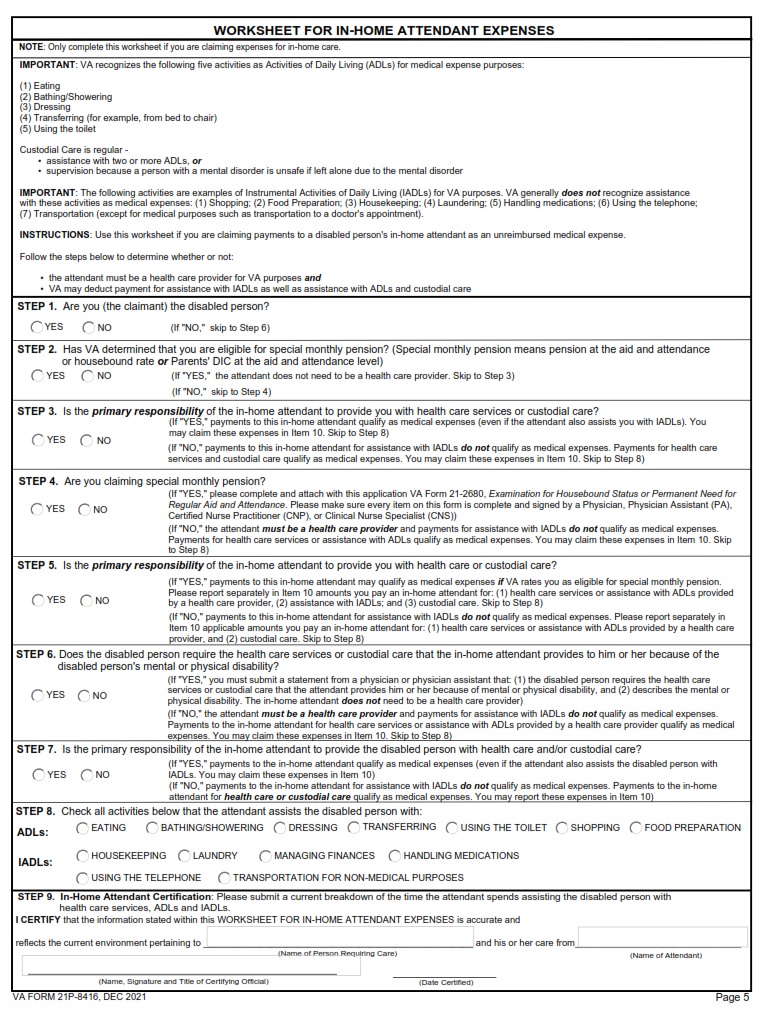

You can use the VA medical expense reimbursement form to report expenses for yourself, your spouse, and your children. You must also include the name of the doctor and hospital, along with the date and purpose of payment. You can also report expenses for transportation, such as gas and car maintenance. If you plan to use the VA medical expense reimbursement form to claim income-based benefits, you must also include the amount of your unreimbursed medical expenses.

VA Form 21P-8416 – Medical Expense Report

Often referred to as a Medical Expense Report, VA Form 21P-8416 is used by veterans and beneficiaries to report their medical expenses. The Department of Veterans Affairs uses this form to help determine if a service-connected condition qualifies for compensation. The number of benefits will be calculated based on the number of expenses incurred. VA Form 21P-8416 can be filed online or in person at your local VA benefits office.

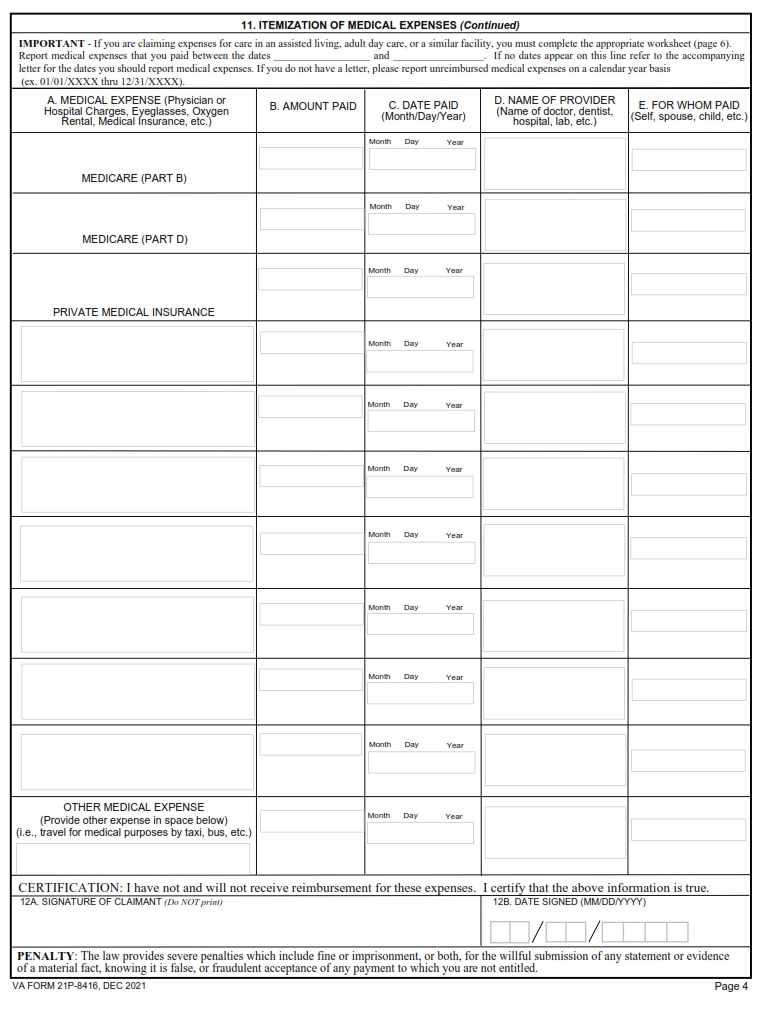

The form requires certain information, such as the claimant’s name, social security number, mailing address, and day and evening telephone numbers. It also includes a chart titled, “Itemization of Medical Expenses.” This chart asks for the date, the amount, and the provider. It also requires the claimant’s signature. If the form is not signed, the document will be returned.

The VA recognizes two categories of medical expenses. These include prospective and actual. In order to qualify for compensation, medical expenses must not have been expected to be reimbursed. If expenses are reimbursed, the claimant is not required to report them.

Medical expenses are also used to determine whether or not a veteran qualifies for income-based benefits. The Department of Veterans Affairs requires medical expense submissions after the end of each year, after approval of a benefits application, and after a significant change occurs.