VAFORMS.NET – VA Form 26-6393 – Loan Analysis – If you’re looking to borrow money from a mortgage company to help you buy a new house, you will need to complete a VA Form 26-6393. This form will help you find out how much money you can afford, and whether you can afford to pay it off over time.

Download VA Form 26-6393 – Loan Analysis

| Form Number | VA Form 26-6393 |

| Form Title | Loan Analysis |

| Edition Date | November 2022 |

| File Size | 890 KB |

VA FORM 26-6393 (186 downloads )

What is a VA Form 26-6393?

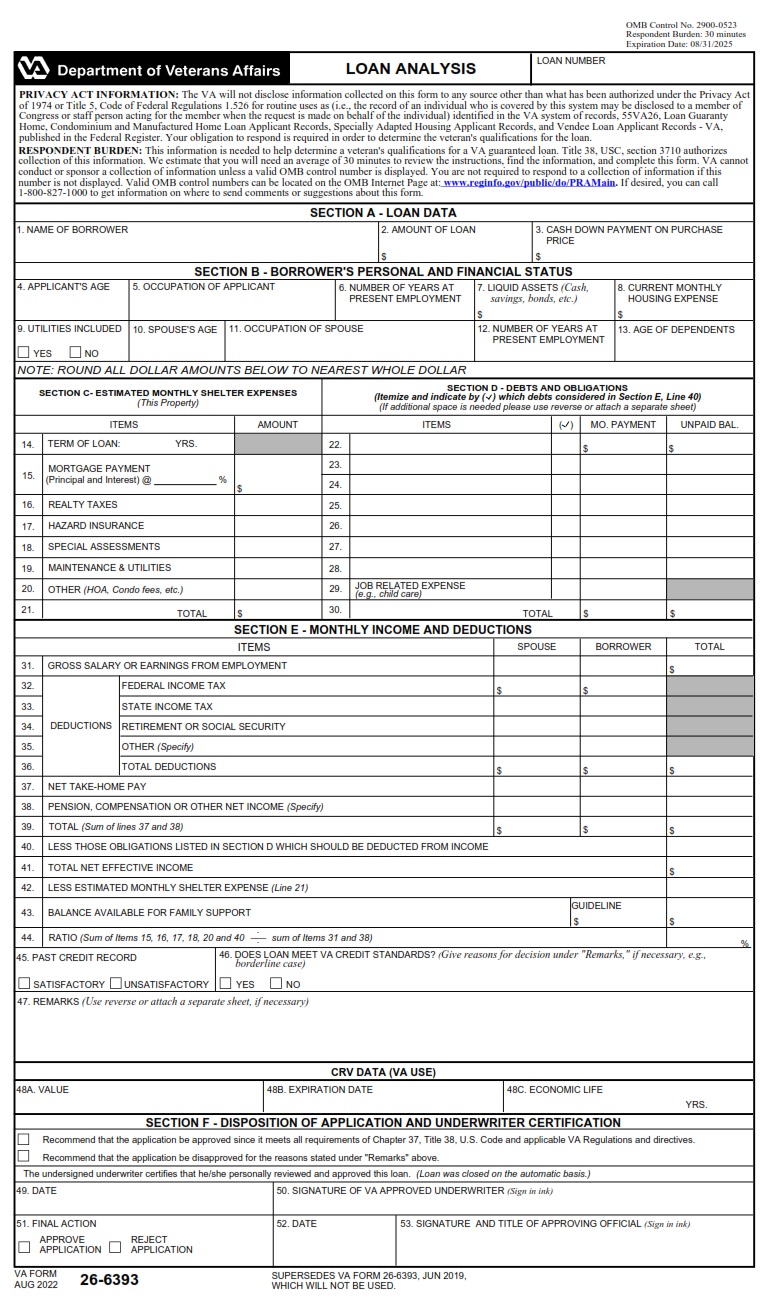

When you are in the market for a VA loan, you’ll most likely receive a copy of the 26-6393 Loan Analysis form. This is a helpful tool when underwriting a VA loan. It combines information from different reports and makes the process of getting a loan a lot more efficient.

The form is divided into five sections. These include the A, B, C, D, and E. Section A asks you to provide general information about your personal finances. In the other sections, you’ll need to fill in more specific details. Fortunately, there are many helpful tools to help you do just that.

One such tool is a free online app called Document Editor. This software works on any device and platform. You can upload files from your computer, mobile device, or cloud. There are also several features that allow you to edit and add text, images, and other documents. Creating copies of the form is a great idea to avoid future mishaps.

Another feature is the multi-functional toolbar. It’s designed to help you highlight particular elements and conduct various commands. And it even comes with an option to make an MS Word document printout!

The VA Form 26-6393 has five major sections. Each of them is an interesting and useful piece of information.

Where Can I Find a VA Form 26-6393?

VA Form 26-6393 is an important tool in the process of obtaining a VA loan. It is used to assess a borrower’s present and future income and expenses. This form is also used to calculate the debt-to-income ratio. The VA will not disclose the information collected on this form to anyone.

A copy of the 26-6393 form is included in the VA loan packet. It is a five-section form that asks for information about various categories of information. For instance, the form asks for general information about the applicant, the loan amount, and the loan purpose.

The form is designed to streamline the loan process. Some of the required fields may already be filled out in the starter packet. Other fields may need to be updated. You can edit this form to make it more accurate and complete. In addition, you can add or delete fields to suit your needs.

As part of the VA loan processing process, you will need to provide a revised pay stub and VA loan agreement. You will also need to obtain approval for your repayment plan. When you have completed these steps, you can begin filing for discharge.

To learn more about this form, you can visit the VA’s website. There you can find an online tool that allows you to fill out the form and electronically sign it.

VA Form 26-6393 – Loan Analysis

If you are a veteran, you may need to fill out VA Form 26-6393 – Loan Analysis. This form will help you determine if you qualify for a mortgage loan from the Veterans Benefits Administration. The form is used to evaluate your present income and expected expenses. It is important to complete the form accurately because the numbers you enter can impact the approval of your loan.

You can submit the completed form by email or mail. If you choose to mail it, you’ll need to prepare a hard copy. To make the process easier, you can use a printable, word-processing template. These templates come with a number of features, including a multifunctional toolbar. This toolbar will allow you to edit text and highlight certain elements. Additionally, you can upload documents from your computer or from the cloud.

In addition to reviewing your present income and anticipated expenses, the form also evaluates your credit history. The purpose of this information is to ensure that you can make the monthly payments for the mortgage.

For example, section C asks you to estimate your housing expenses. Those costs include maintenance, HOA fees, and utilities. Estimates will depend on where you live and the size of your household. Also, you’ll need enough residual income to cover your monthly debt payments.