VAFORMS.NET – VA Form 26-8106 – Statement of Veteran Assuming GI Loan (Substitution of Entitlement) – The VA Form 26-8106 is used when a veteran assumes a GI bill. It is also known as the Statement of Veteran Assuming GI Benefits. This form is a requirement for any applicant who is eligible for a GI bill. When applying for a GI bill, a veteran will need to provide information about their current address, income, and tax filing status. Having the information on hand will make the process of filing a claim for GI benefits much easier.

Download VA Form 26-8106 – Statement of Veteran Assuming GI Loan (Substitution of Entitlement)

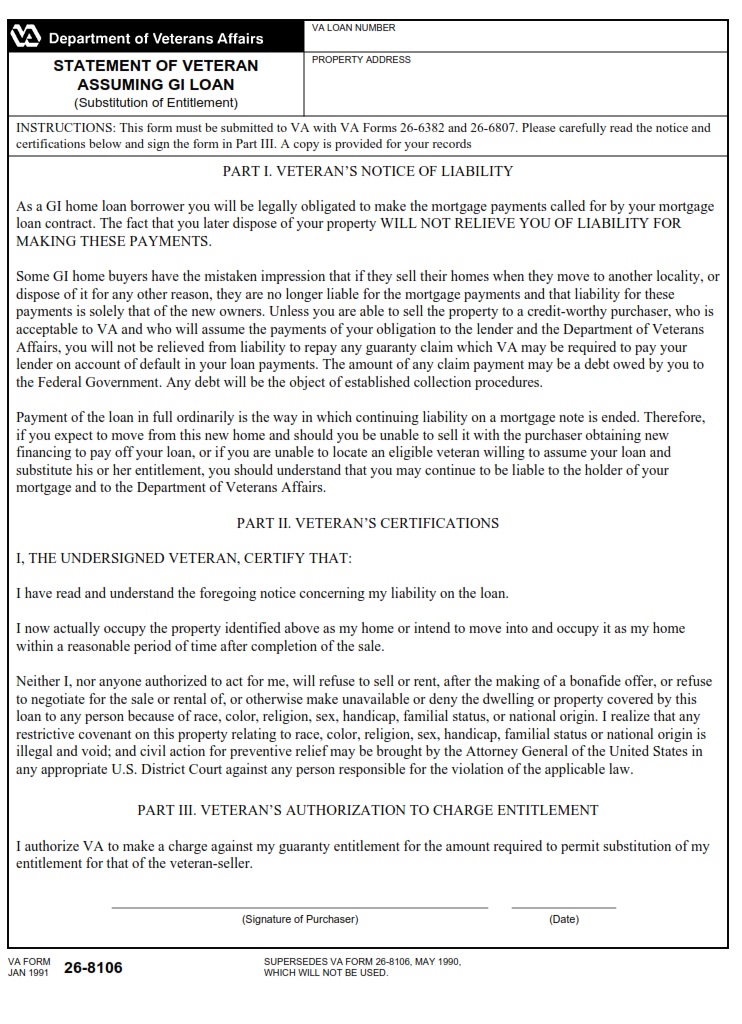

| Form Number | VA Form 26-8106 |

| Form Title | Statement of Veteran Assuming GI Loan (Substitution of Entitlement) |

| Edition Date | June 2022 |

| File Size | Form last updated: 643 KB |

VA FORM 26-8106 (1777 downloads )

What is a VA Form 26-8106?

VA Form 26-8106, or the “Borrower’s Statement of Liability-GI Loan”, is a form that advises borrowers of their obligations to repay the loan. It also informs borrowers of the guaranty claim available to them.

This form is used in connection with a certificate of eligibility for a VA home loan. You can obtain this certificate by filling out Form 26-1880 and submitting it to the Winston-Salem Office of Eligibility.

Generally, this is not a complicated process. Lenders are not required to approve your request. However, there may be fees involved, depending on the lender. These fees can be as low as a few hundred dollars, or as high as a few thousand.

To be eligible for this type of loan, you must meet the income and credit requirements of the VA. Aside from that, you will also have to fill out a VA loan assumption application.

One of the best reasons to consider this option is that you will have access to lower interest rates. Another benefit is that you will be able to sell your home quickly without having to go through the hassle of applying for another loan.

A VA loan assumption can save a lot of time and energy and will help you avoid having to pay for an appraisal. In fact, you don’t even need to wait until your house sells to be eligible.

Where Can I Find a VA Form 26-8106?

The VA Form 26-8106 is called the “Borrower’s Statement of Liability-GI Loan”. This form tells borrowers of their obligations on a guaranty claim. It is an important document for VA loan borrowers.

Besides being a source of information, the VA Form 26-8106 can be a great tool for a military veteran looking to sell his house. It can also be a tool for a surviving spouse who is interested in buying a new home.

You can find the VA Form 26-8106 online or by mailing it. In addition, you can download or edit the form on your computer. Once you have the form, you can print it or share it through email.

Assuming a VA loan is a good option for buyers who are looking for lower interest rates, especially if they are looking to purchase a house fast. However, the process of assuming a VA loan can take a little longer than it would if you sold your home on the market.

You will have to meet credit requirements, though, before you can assume a VA loan. These guidelines vary from lender to lender, so you’ll want to make sure you know what’s required of you before you apply.

VA Form 26-8106 – Statement of Veteran Assuming GI Loan (Substitution of Entitlement)

If you are a veteran, there are many ways to “swap” your entitlements. One of these options is assuming a VA loan.

The process can take anywhere from 45 days to several months, depending on the lender and circumstances. While the process is not a requirement to sell your home, it may be a good idea to weigh the pros and cons of assuming a VA loan before committing to the transaction. Having your mortgage assumed will also save you the hassle of applying for a new loan.

First, you must get a VA appraisal on your property. This is not an inspection but rather an estimate of the value of your property. Normally, the lender will request this information via the internet.

Next, you must have a lender who specializes in VA loans. These lenders will provide you with more information about this type of loan and can assist you with your application. You will also need to meet some credit requirements.

Finally, you will need to complete a series of legal documents. In particular, you will need to get a liability release from the original borrower.

This is the smallest loan of all, but it will have the biggest impact on your overall financial picture. Luckily, the VA has an excellent website that can help you with this.

VA Form 26-8106 Example