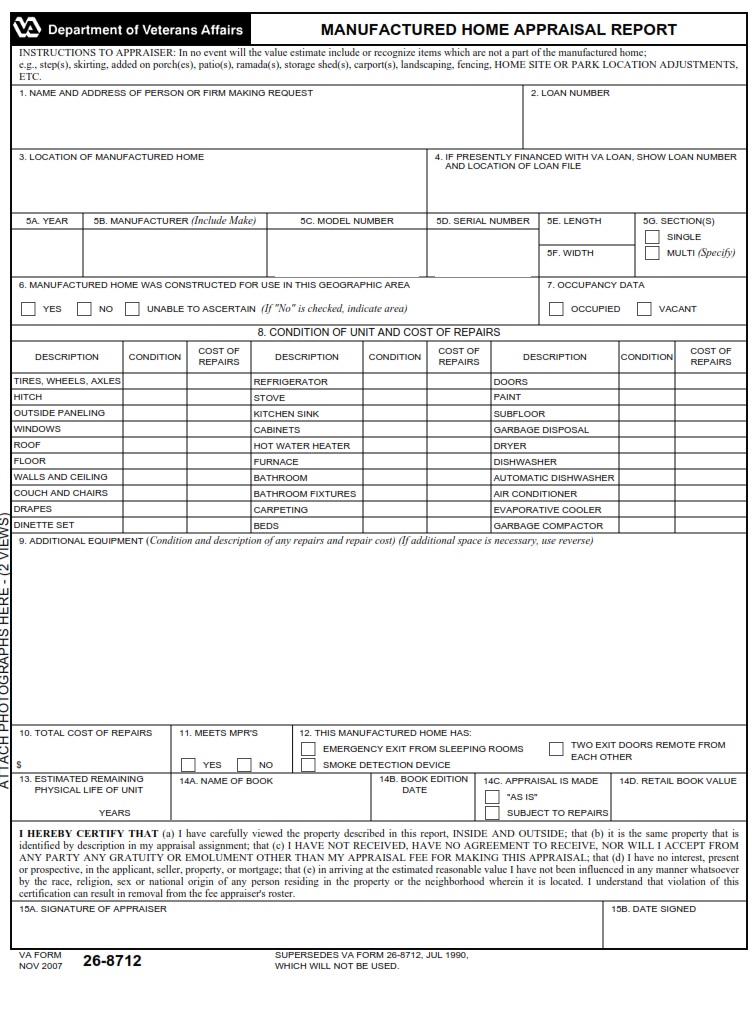

VAFORMS.NET – VA Form 26-8712 – Manufactured Home Appraisal Report – The VA Form 26-8712 is a form for the manufactured home appraisal reports. It can be used by lenders, realtors, and anyone involved in purchasing or selling a property that is a repossessed manufactured home. You can find a copy of this form on the US Department of Veterans Affairs website, where you can also read more information about it.

Download VA Form 26-8712 – Manufactured Home Appraisal Report

| Form Number | VA Form 26-8712 |

| Form Title | Manufactured Home Appraisal Report |

| Edition Date | July 2022 |

| File Size | 797 KB |

VA FORM 26-8712 (1317 downloads )

Where Can I Find a VA Form 26-8712?

If you’re a VA buff, you have probably already heard of the new VA Form 26-8937. While this new form is an important part of the VA’s Automated Certificate of Eligibility application, you’ll have to do your part to submit it correctly. In order to make this process as painless as possible, you’ll need to know where to find the proper doc. Luckily, the VA has a handy guide for all you need to know about submitting this new form.

The new Form 26-8937 is not the only new thing that the VA has done. They have also released a new set of tools to help veterans and caregivers alike. This includes a new training webinar and a handy guide.

VA Form 26-8712 – Manufactured Home Appraisal Report

Manufactured home appraisal repo is a type of appraisal report based on the exterior and interior inspection of a manufactured home. This form of the appraisal report is used to provide an opinion of the value of a manufactured home. It is used by lenders, mortgage insurers, and other financial organizations. To order this report, lenders must contact an appraiser and obtain consent. The lender may also disclose the appraisal report to secondary market participants, such as mortgage insurers, borrowers, and other organizations.

In addition, a lender can disclose an appraisal report to other parties, such as the state or government. Lenders can also disclose an appraisal report to professional organizations. These organizations are a source of reliable data that can be used in the appraisal. A lender can also disclose an appraisal report to the client, who is usually an individual or an organization. A lender can also disclose an appraisal report as required by law. As with other appraisal reports, a lender may not disclose an appraisal report if the report contains inaccurate information, if the appraiser is no longer practicing as an appraiser, or if the lender is no longer in business. However, a lender may disclose an appraisal report to the mortgagee and any other party to a transaction if it is in the best interests of the borrower.