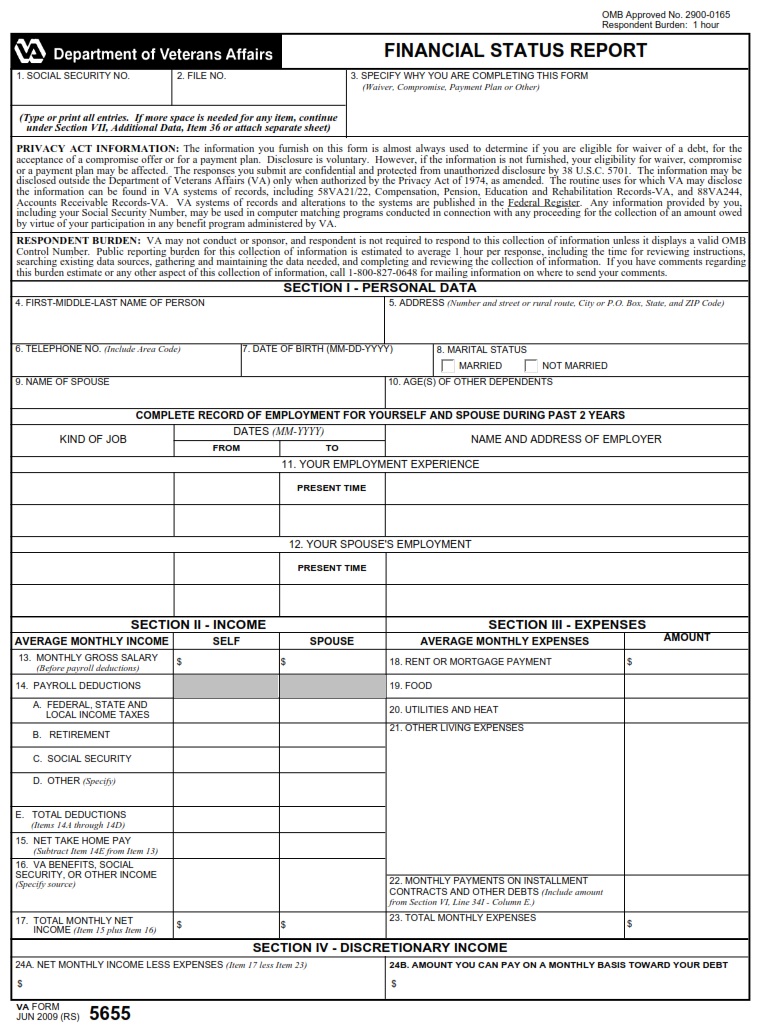

VAFORMS.NET – VA Form 5655 – Financial Status Report – The VA Form 5655 is a form that can be used by veterans who need to update their information on their service. It is also known as the Financial Status Report. When you use this form, you will need to write a detailed description of your personal finances and any tax issues you have. This form is also important if you are planning to apply for financial benefits from the Veterans Administration.

Download VA Form 5655 – Financial Status Report

| Form Number | VA Form 5655 |

| Form Title | Financial Status Report |

| Edition Date | August 2022 |

| File Size | 1 MB |

What is a VA Form 5655?

VA Form 5655 is a form that contains a lot of information. In general, it is used to collect data for a potential program participant.

The information gathered on this form will help the Department of Veterans Affairs determine if the declarant is eligible for a variety of benefits. These include waiver of debt, payment plans, and compromise offers.

The Financial Status Report is one of the most important reports the Department of Veterans Affairs has to offer. It helps determine if the declarant is eligible for special compromise offers.

Often, the Financial Status Report will be used in conjunction with other VA forms. For instance, it is required if the declarant wishes to receive a monthly payment.

This report is also required for wartime Veterans who may receive benefits that have to be paid off regularly. Usually, the VA office will not consider a claim unless the Financial Status Report has been filed.

The reason the VA uses the Financial Status Report is that it helps to understand the big picture of a benefit recipient’s finances. When this document is completed, the office will have a clearer idea of how much the person is making and how much he or she can afford to pay.

Where Can I Find a VA Form 5655?

If you have received an overpayment notice from the Department of Veterans Affairs, you may need to fill out a VA Form 5655. The form reflects your financial situation, and it is used to determine if you qualify for debt relief programs.

VA Form 5655 is also known as the Financial Status Report. This document is a summary of your household’s income, assets, and liabilities. In addition, it includes details about your spouse and your employment history.

You must submit the form to the Department of Veterans Affairs within 30 days of receiving the overpayment notice. In addition, you must send a dispute letter to the Department of Veterans Affairs, as well.

The VA Financial Status Report is one of the most important reports. It provides a zoomed-out view of your overall finances, and it helps the VA to determine repayment options.

VA Form 5655 is also used to request a payment plan or waiver. However, submitting the form isn’t always mandatory. Some people can afford the plan without having to fill out a formal application.

VA Form 5655 can be filled out with an online form filler such as SignNow. This online form filler allows users to import documents from various sources, and add images and textual information. Users can export the documents to the cloud, edit them in an online editor, and share them through email.

VA Form 5655 – Financial Status Report

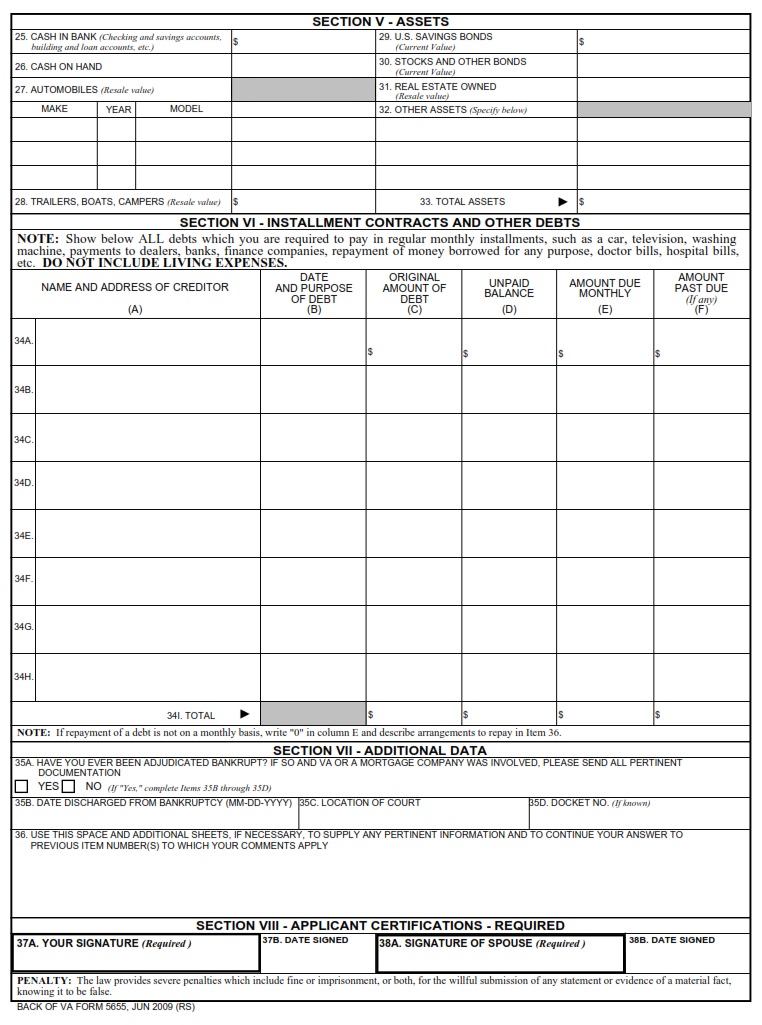

VA Form 5655 is a form that provides an overview of a debtor’s financial situation. This information is used by the Department of Veterans Affairs to determine a Veteran’s eligibility for various benefits and payment plans. It also helps to determine whether the Veteran is eligible for special compromise offers.

VA Form 5655 can be completed online. To fill out the form, you will need to provide the following information: VA file number, Social Security Number, name and address, and a statement of purpose.

The first section of the form asks for details about your spouse’s income and employment history. You will need to include information such as gross monthly salary, payroll deductions under state or federal taxes, and other deductions.

Section II requires the name, age, and marital status of your spouse. In addition, you will need to describe your monthly living expenses in the third section. These include rent, mortgage payments, food, utilities, and heat.

The fifth and sixth sections of the form ask you to enter details about the number of your discretionary earnings. If you are receiving a partial refund of benefits, you will need to indicate that in the third block of the form.

In the ninth and tenth sections of the form, you will need to detail any other sources of income. You will also need to report any income from part-time jobs.