VAFORMS.NET – VA Form 21P-10199 – Legal Summary—Survivors Pension, Dependency and Indemnity Compensation, and Accrued Benefits – Whether you are a veteran who wants to file a claim for disability compensation, or a civilian who wants to know more about how the VA handles claims for compensation, you can find out more about the VA Form 21P-10199. This form is available on the VA website and can help you determine whether you qualify for benefits.

Download VA Form 21P-10199 – Legal Summary—Survivors Pension, Dependency and Indemnity Compensation, and Accrued Benefits

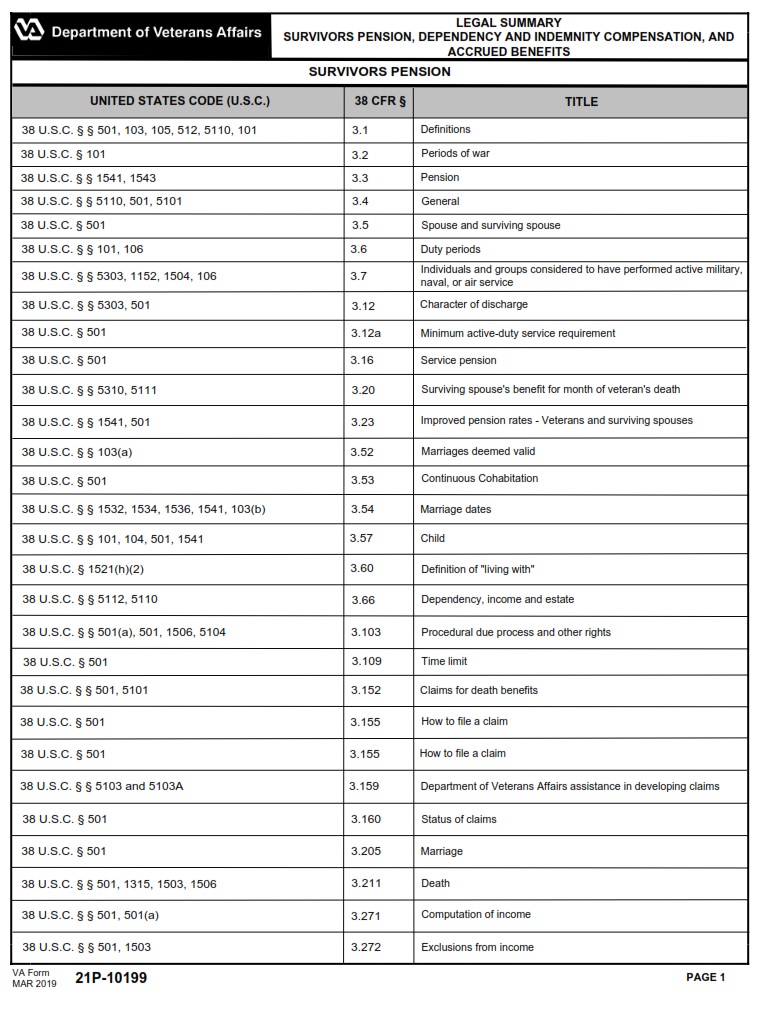

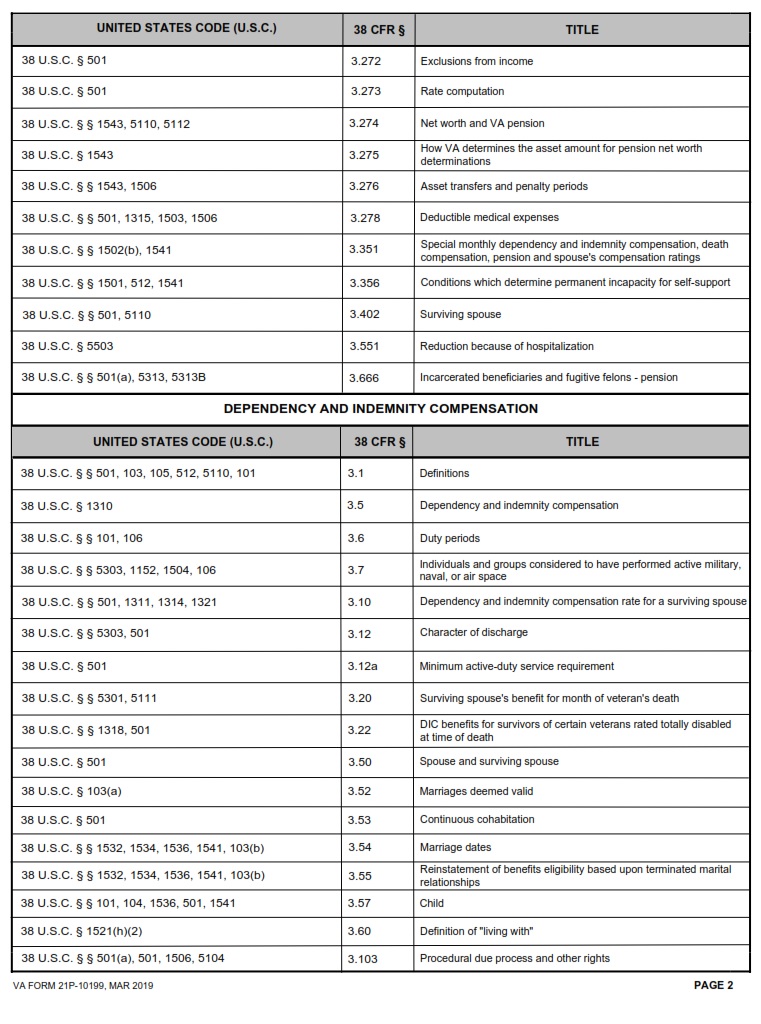

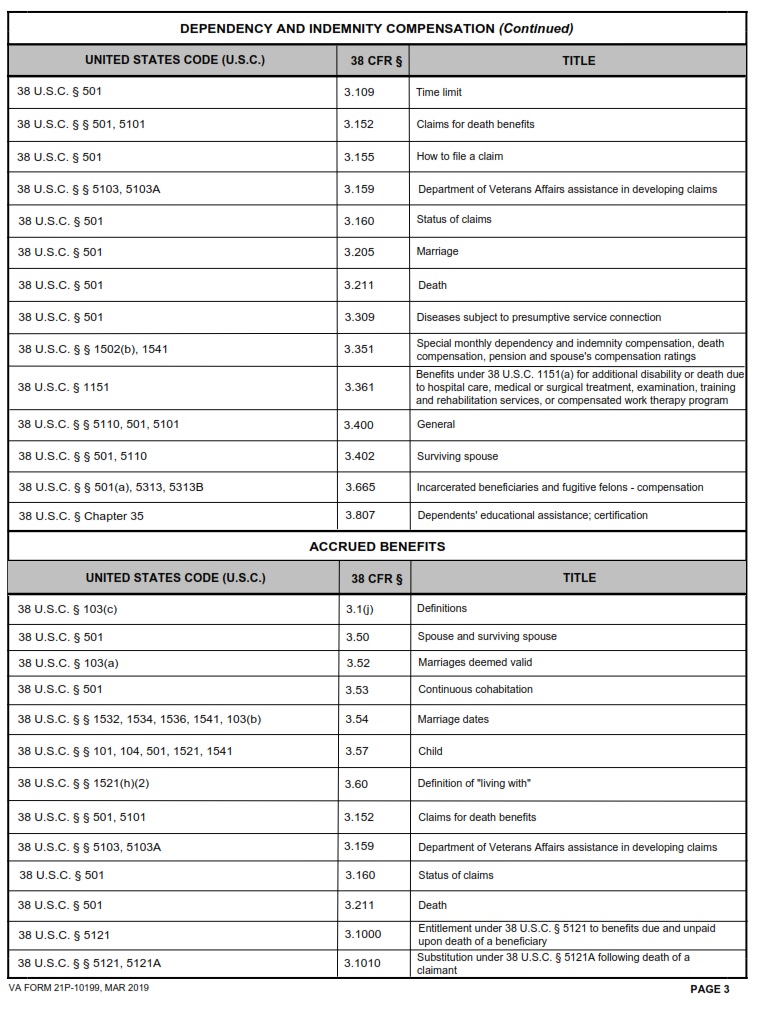

| Form Number | VA Form 21P-10199 |

| Form Title | Legal Summary—Survivor’s Pension, Dependency and Indemnity Compensation, and Accrued Benefits |

| Edition Date | May 2022 |

| File Size | 206 KB |

VA Form 21P-10199 (154 downloads )

Where Can I Find a VA Form 21P-10199?

Whether you’re a current or former military member, you should be eligible to claim a VA Form 21P 10199. This document outlines your eligibility to receive various benefits, including compensation, education, retirement, and burial benefits. Using this form will make sure you get the most out of your VA benefits. Among other things, you can qualify for a VA Survivor’s Benefit Plan, a tax-free payment for un-remarried surviving spouses and children. Aside from these benefits, your military service also qualifies you for VA’s most popular benefits, including burial benefits and life insurance.

While the Survivor’s Benefit Plan is a good place to start, you might also want to consider other options, such as the Survivor’s and Dependent’s Retirement Program and the Survivor’s and Dependent’s Health Care Program. These programs allow you to take advantage of a wide variety of benefits, including lifetime medical coverage, VA disability compensation, and education and training assistance.

VA Form 21P-10199 – Legal Summary—Survivors Pension, Dependency and Indemnity Compensation, and Accrued Benefits

Survivors Pension, also formerly known as the Death Pension, is a tax-free payment made to eligible spouses of veterans who died from service-related causes. The payment is also made to unmarried children of veterans. The benefit rate is based on the maximum annual pension rate of the veteran and the financial status of the surviving spouse. If the surviving spouse has a child who is not eligible for DEA, he or she may also be eligible for Dependency and Indemnity Compensation (DIC) for children under the age of 18.

In addition to a Survivors Pension, a VA Survivor’s Pension may be payable to the surviving spouse of a veteran who died in an unrelated accident, or if the veteran died in a nursing home. In order to apply, the surviving spouse must complete the VA Form 21P-534-EZ. The information submitted is subject to verification through computer matching programs. The surviving spouse is not eligible to receive burial benefits if the veteran was serving in an active duty position.

The surviving spouse’s benefit rate may be adjusted to a higher rate if the surviving spouse has a low income or needs regular aid. The rate may also be adjusted if the veteran was blind or had a disability.