VAFORMS.NET – VA Form 21P-0518-1 – Improved Pension Eligibility Verification Report (Surviving Spouse with No Children) – Whether you are looking to apply for the VA Form 21P-0518-1 or just want to find out more about it, you will need to know some things first. This article will explain what the form is and where you can find it. If you are a veteran, you will need to fill out this form in order to receive your pension. In addition to this, you can also use this form to apply for an improved pension.

Download VA Form 21P-0518-1 – Improved Pension Eligibility Verification Report (Surviving Spouse with No Children)

| Form Number | VA Form 21P-0518-1 |

| Form Title | Improved Pension Eligibility Verification Report (Surviving Spouse with No Children) |

| Edition Date | May 2022 |

| File Size | 812 KB |

What is a VA Form 21P-0518-1?

Getting your hands on a VA Form 21P-0518-1 is like winning the lottery. This one-page form is the holy grail of forms to this day and age. The best part is that it is available for free. Of course, you don’t have to wait for a free form to be completed; if you want one, you can download it and fill it out on your own. You can even get it signed by a vet if you’re so inclined. The best part is, you can take the form home with you. If not, you can have it delivered to your door via FedEx.

Where Can I Find a VA Form 21P-0518-1?

Using Va Form 21P-0518-1 can help you claim deductions from your Virginia taxes. You can claim a child and dependent care credit, the American opportunity credit, and tuition and fees deduction. In addition, you may be able to claim the military service credit and the dependent care credit. However, before using this form, you must ensure you are eligible for these deductions.

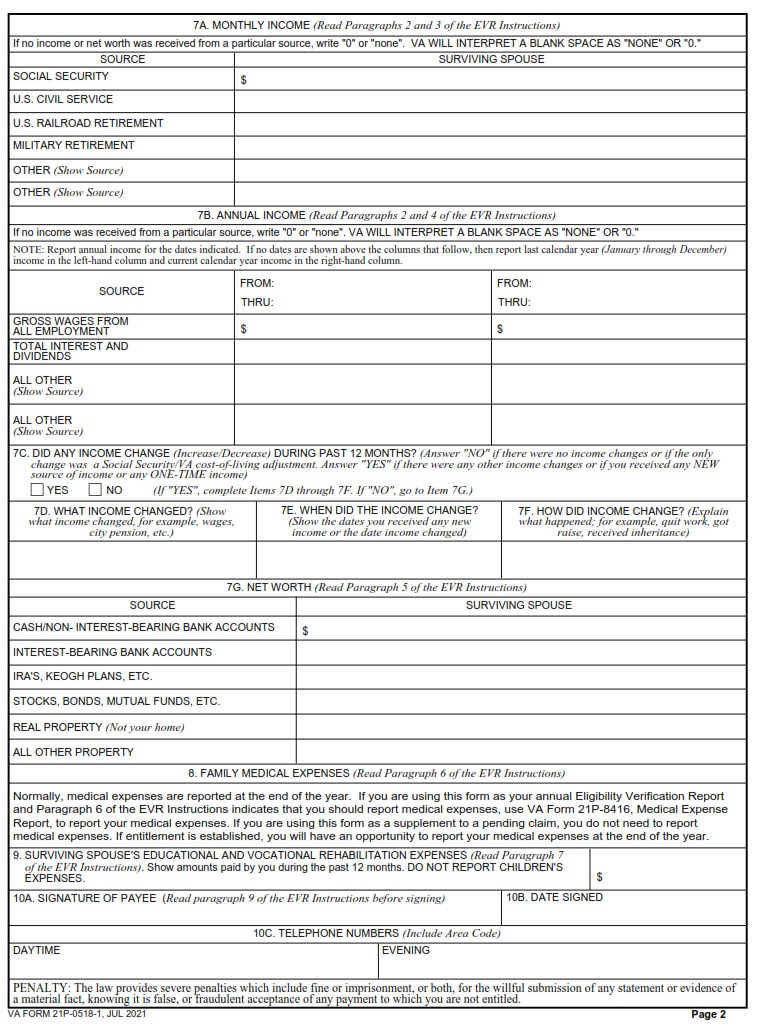

An EVR (Eligibility Verification Report) is an annual report that VA requires to verify your continued entitlement to benefits. The report can also be used to supplement a claim. The report includes information on the claimant’s income, dependency status, and medical expenses. It also provides an overview of the claimant’s financial history for 36 months or three years.

The VA also requires medical expense reporting on VA Form 21P-8416. The report must be completed by the beneficiary twice. The information provided on the form must be verified through computer matching programs. If the information provided is incorrect, the VA may deny the claim.

The VA also requires you to provide evidence of the amount of income and assets you have. This report also requires you to disclose the net worth of your family. It includes the value of your home, vehicles, and other assets. The net worth limit is set by the VA at $123,600. If you fail to report your income and assets within this limit, your monthly award may be suspended or revoked.

VA Form 21P-0518-1 – Improved Pension Eligibility Verification Report (Surviving Spouse with No Children)

Whether you’re a taxpayer or a VA beneficiary, the VA Form 21P-0518-1 – Improved Pension Eligibility Verification Report (Surviving Spouse with No Children) is an important tool that can help you streamline the filing process. This form provides a number of deductions that can help you save money on your taxes. But you must be sure that you’re eligible before filing. If you’re not eligible, you could lose your benefits. Here’s how to check.

The VA Form 21P-0518-1 consists of several pages. It’s a military form that can be filled out online or downloaded in PDF format. You can then save or edit it using a digital tool. You can also add an electronic signature. You can share documents with others through email or through a cloud service.

The VA Form 21P-0518-1 is also used to claim the child and dependent care credit, American opportunity credit, and tuition and fees deduction. It can be a helpful tool if the beneficiary is not receiving the maximum amount of pension that he or she is entitled to.

If you have a dependent child, you may qualify for a higher pension rate if the child is blind or disabled, or has a disability. You can also qualify for a higher rate if you’re a surviving spouse or if you’re living in a nursing home.

VA Form 21P-0518-1 Example