VAFORMS.NET – VA Form 22-10216 – 35% Exemption Request From 85/15 Reporting Requirement (Fillable) – Obtaining the VA Form 22-10216 is a great way to ensure that you are receiving the benefits you deserve. This form is also referred to as a 35% exemption request. This form is used to request that the government exempt you from paying a portion of your Social Security taxes. This form is available online or can be downloaded from the Department of Veterans Affairs website.

Download VA Form 22-10216 – 35% Exemption Request From 8515 Reporting Requirement (Fillable)

| Form Number | VA Form 22-10216 – |

| Form Title | 35% Exemption Request From 85/15 Reporting Requirement (Fillable) |

| Edition Date | February 2022 |

| File Size | 1 MB |

VA FORM 22-10216-35 (211 downloads )

What is a VA Form 22-10216?

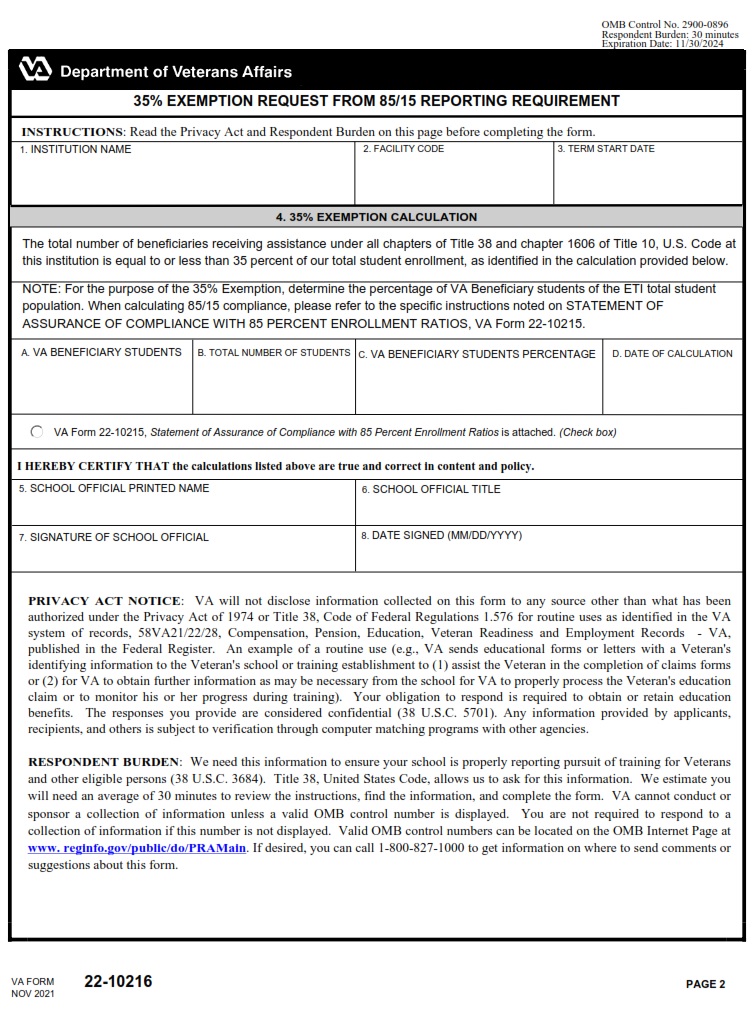

Whether you are an accredited institution or an unaccredited ETI, you will be required to complete VA Form 22-10216. The purpose of this form is to report data on all eligible VA beneficiary students enrolled in approved courses of study. You can find the form at most VA regional offices.

The form should be filled out with a formal application for admission. Before you begin, you may want to set up a folder for all relevant educational assistance documents. This should include the aforementioned VA Form 22-10216 and the requisite DD Form 214. The latter is a must for your records and may be needed as proof of eligibility should you ever file a claim.

The most important part of the form is the VA’s evaluation of your program’s compliance with 85/15. It is estimated that a typical respondent will spend about 30 minutes on this exercise. You will also be required to provide written confirmation that the requirements have been met. You should also prepare a list of all supported student enrollments. This is particularly useful as you will be required to monitor and report any changes.

The VA has a number of educational assistance programs. The best known is the Vocational Flight School (VFS) program, which provides military pilots with instruction on a variety of aviation-related topics.

Where Can I Find a VA Form 22-10216?

Whether you are a seasoned vet or a prospective student unsure of where to find VA Form 22-10216, it’s never too late to start your education journey on the right foot. For information on how to apply for the benefits of VA educational assistance, visit VA’s website or call VA’s toll-free hotline at 877.459.3600. If you are curious about VA’s program eligibility requirements, check out their FAQs page.

Aside from the VA’s official website, you can also check out their AppalNet portal to see if you qualify for the benefits of VA educational assistance. While you are there, you might as well complete the enrollment data sheet. The best part is you can do it without an appointment. You can even print a copy. Aside from the benefits of VA educational assistance, you’ll also get access to other government services, such as medical and dental insurance. Depending on the program you qualify for, you may be eligible for additional benefits. The most popular VA education programs include the Yellow Ribbon program, the Montgomery GI Bill, Post-9/11 GI Bill, and the National Guard tuition benefit. There are many more programs in place, but you can find them by browsing the e-services section of the VA’s website.

VA Form 22-10216 – 35% Exemption Request From 85/15 Reporting Requirement (Fillable)

Until July 1st, educational institutions that wish to apply for a 35 percent exemption from the 85/15 rule will need to submit a VA Form 22-10216 to the Education Liaison Representative. The request will be considered in conjunction with the routine reporting period for that quarter. In the case of colleges, the report would be due within 30 days of the beginning of the fall term and the end of the calendar quarter.

The 85/15 rule was created to combat predatory for-profit schools targeting veterans after World War II. The rule was modified several times over the years. The 90-10 rule continues to protect veterans from the risk of being financially ruined by fraudulent for-profit schools.

The 85/15 rule also has a number of requirements. For example, schools that have a high course load must contact the ELR to find out how they measure training time. In addition, they will need to monitor their VA data. If they do not monitor their VA data, they will have to apply for a 35 percent exemption.

Schools can certify nonmatriculated college students for two quarters or semesters. A nonmatriculated student is not eligible to receive VA educational benefits. These include refresher courses, remedial education, basic skills, and certificate programs.